earn more trust. grow more business.

Future of Cyber Insurance

Although the cybersecurity industry has been hard at work improving protective and preventive solutions, digital criminals are also making serious improvements to their tactics. As these bad actors continue to formulate new methods to thwart security measures, the global digital ecosystem becomes even more dangerous. Currently, every individual and business is at risk.

That is why, cybersecurity insurance has become a vital asset to protect against digital crime. But what’s next for cyber insurance? Is cyber insurance on the rise? Will it retain its relevance in the coming years?

Throughout this blog, Trava Security will answer these questions to illustrate what current trends, innovations, and challenges are shaping the future of cybersecurity insurance.

Why Is Cyber Insurance Important?

Cyber insurance is a necessity today because of the exponential increase in cybercrime around the globe. McAfee reported that up to 1% of the world’s GDP is now being lost to cybercrime. In the United States alone, the FBI received more than 800,000 cybercrime complaints in 2022, with losses totaling over $10 billion. Suffice it to say that businesses in the US and abroad are under constant threat.

To further complicate things, cybercriminals are adding new tools to their arsenal every day. For example, AI is now being used to orchestrate highly advanced attacks. This includes deep fakes and other forms of digital trickery used to spread misinformation and scam businesses. The constant evolution of cyber attacks makes it extremely difficult for businesses to keep up and effectively future-proof their digital security strategies.

Ultimately, it’s only a matter of time before any business faces some kind of cyberattack. This makes cyber insurance a necessary asset for all companies. Should the worst happen, cyber insurance ensures that all financial losses will be mitigated, potentially saving a business from complete ruin.

Why Is Cyber Insurance for Small Businesses Important?

Although many small business leaders assume they are not the main target of cybercriminals, they are mistaken. Just like enterprise organizations, small businesses store sensitive information in a digital environment, which is highly prized by cybercriminals. Additionally, many criminals see small businesses as easy marks and seek to target these operations specifically. In fact, one report found that small businesses are three times more likely to be targeted by cybercriminals than larger companies.

Is Cybersecurity Insurance Enough?

Your customers must understand that although cyber insurance is necessary, other protective and preventive measures are needed to have a comprehensive security plan. To help you get a baseline of what your customers should be doing to mitigate cyber vulnerabilities, here is a helpful checklist:

Effective Cybersecurity Tactics Your Clients Should Be Using

-

Creating a disaster plan

-

Initiating multi-factor authentication

-

Providing cybersecurity training for all employees

-

Backing up their data to remote servers

-

Examining potential insider threats

-

Running regular vulnerability tests to identify weaknesses in their security system

-

Updating their network security regularly

-

Limiting account access

-

Removing unnecessary or unexpected hardware, software, and network

-

Updating software and hardware

-

Monitoring third-party security posture

What Is the US Cyber Insurance Market Outlook?

Because digital security risk continues to climb, the cyber insurance market is booming both within the US and elsewhere. Fitch Ratings reported that the US cyber insurance sector grew by 51% in 2022 to surpass $7.2 billion. That same report found the cyber insurance industry experienced 73% premium growth in 2021. From a global perspective, Fortune’s latest cyber insurance market report states that the global cyber insurance market size will likely reach $16.66 billion in 2023 and $84.62 billion by 2030.

This heightened demand can likely be attributed to increased digitization throughout all business sectors, the evolving complexity of cybercrime attacks, and the impact the COVID-19 pandemic had on how we all work together.

Speaking to that last point, it is important to consider the increase in remote work and the challenges it poses to company security. With more workers operating outside of the office, cybersecurity measures are becoming increasingly difficult to enact and enforce. One study found that 67% of business-impacting cyber attacks targeted remote workers. Considering there’s no real push to return to the office, these challenges will likely drive further demand for insurance solutions.

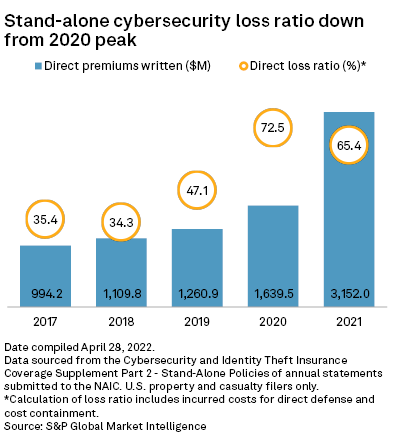

In addition to increased demand, cyber insurance companies have been able to improve their profitability. As providers become more thorough and cautious with their underwriting processes, cyber insurance loss ratios have significantly improved. According to S&P Global Market Intelligence, the average loss ratio for stand-alone policies fell to 65.4% in 2021 from 72.5% in 2020.

Ultimately, it is safe to say the cyber insurance industry stands to be highly profitable and stable throughout the coming years.

What Are the Most Noteworthy Cyber Insurance Trends?

Regarding the evolution of cyber insurance, there are three trends that providers should keep a close eye on: social engineering hacks, cryptocurrency, and cyber warfare.

1. Social Engineering Hacks

In addition to ransomware, social engineering has emerged as a highly dangerous and effective method of compromising sensitive digital assets. Unlike ransomware, which solely focuses on attacking systems and networks, social engineering tactics involve manipulating a person or persons to uncover weaknesses within an organization’s infrastructure. Regarding this evolving issue, Insurance Business Magazine interviewed Risk Placement Services (RPS), one of the largest North American specialty insurance products distributors. In this interview, RPS revealed that their cyber insurance research uncovered significantly more fraudulent payments and social engineering fraud (over 50%) than ransomware (16%) between January and August of 2022. However, this does not mean ransomware should be overlooked. Rather, this information suggests that social engineering attacks should be monitored with the same intensity as ransomware incidents.

2. Cryptocurrency

Bad actors are taking advantage of the widely unstable cryptocurrency market to orchestrate crypto-threats at an alarming rate. These hacks are a gold mine for cybercriminals and often earn them sums totaling in the millions and, sometimes, billions of dollars. Because more businesses are accepting and using cryptocurrency, the need for cyber insurance policies to counter significant crypto-threats has dramatically increased. Therefore, it is worthwhile for all cyber insurers to become well-versed in the risks associated with the crypto industry as this challenge continues to evolve.

3. Cyber Warfare

There is an ongoing debate regarding the insurability of cyber attacks related to cyber warfare and other state-sponsored cyber incidents. According to The Carnegie Endowment for International Peace, it is still unclear if insurance can or should cover state-sponsored cyber incidents, which stifles the cyber insurance market’s stability and growth potential. Recognizing this, many leading global insurance entities are discussing revisions to cyber insurance policies to advocate for greater clarity and transparency. Significant changes could come out of this depending on what is decided, so it’s important to be aware of what is currently being proposed in these discussions.

What Are the Most Significant Cyber Insurance Challenges?

There are many challenges impacting the cyber insurance industry, but three stand out as the most important.

-

Evolving threats and cybercriminal tactics

-

Poor risk assessment practices

-

Expensive premiums

Consistently Evolving Threats

Cyber criminals are becoming increasingly innovative when it comes to formulating new ways to attack businesses. These bad actors are becoming highly specialized, and have been taking advantage of reconnaissance-as-service practices to outsmart even the most sophisticated cyber security measures. For example, Munich RE discovered that many cybercriminals are pursuing newer and more intricate tactics like data destruction, data theft as a form of extortion, and sophisticated ransomware attacks on cloud infrastructure.

Inefficient Risk Assessment Practices

The conventional methods for conducting client risk assessments are wholly inefficient and often inaccurate. The traditional PDF assessments handed to clients give insurance providers very little to go off of, and can often cause insurers to draw the wrong conclusions. Because conventional risk assessment methods are cumbersome and inaccurate, there is a strong demand to revitalize how insurers assess an organization’s security posture. In fact, 89% of insurers believe it would be valuable to have direct access to customer metrics and measures proving the status of their security controls. So, what’s to be done?

Enter, Trava Security.

We make it simple to process quotes quickly and accurately, to ensure that you take on clients with a manageable amount of liability. Our risk assessment technology gives you the accurate and actionable data required to:

-

Create policies that match the needs of your business

-

Ensure a client is the right fit

-

Identify low-risk businesses that can benefit from lower rates

Costly Premiums

It will come as no surprise that global cyber insurance premiums continue to rise. Unfortunately, the surging prices of policies are turning new customers away and discouraging current customers from renewing. Additionally, many insurers are reducing coverage limits as a reaction to soaring costs. The main drivers of premium hikes are increasingly sophisticated threat tactics and expensive attacks. Therefore, the main ways to reduce premiums are by:

-

Encouraging companies to improve their cyber security infrastructure and policies.

-

Empowering insurers to perfect their risk assessment procedures to ensure that unnecessarily risky businesses are not brought on as clients.

Take the First Step to Prevent Incurring Additional Risk

Trava’s Cyber Risk Checkup will provide you with a detailed report of an organization’s vulnerabilities so you can tell which clients to eliminate right away.

Is Cyber Insurance the Future? With Trava’s Help, it Most Certainly Can Be

So long as cybercrime persists, the need for cyber insurance will continue to grow. But demand isn’t everything. The success of the cyber insurance industry ultimately depends on its stability. Without the right data and insights, you might take on clients that aren’t worth the risk, which contributes to the wider issue of expensive premiums. But it doesn’t have to be this way. Trava empowers insurers to accurately and quickly assess a business’s cybersecurity risk level and make informed decisions. Our platform streamlines several critical tasks including:

-

The initial risk assessment

-

Underwriting

-

Readiness reports

-

Renewal preparation

Trava’s core mission is to streamline the risk assessment process, so insurers can confidently offer customized coverage for their customers. With improved access to detailed insights you can give your clients more information about cyber health, and offer improved rates on their policies.

Ready to provide peace of mind with confidence? If so, book a demo to receive a comprehensive rundown of our expansive cyber risk management program.