Cyber liability insurance has become a hot topic in the digital world. As more and more businesses come to realize the importance of staying safe online, they are increasingly investing in cyber protection tools and plans. But what is cyber liability insurance, and how does cyber insurance work? Cyber liability insurance is a type of insurance that helps protect companies from financial losses caused by cyber attacks, data breaches, and other types of cybercrime.

It’s designed to cover a wide range of potential losses, including the cost of notifying affected customers, providing credit monitoring services, and paying for legal fees and other expenses related to a cyber attack. Googling “cyber insurance explained” can give you a more thorough understanding of this type of insurance, which is especially critical for organizations responsible for handling large amounts of sensitive customer data.

There is also cyber insurance for individuals. As the term implies, it is specifically designed for individuals as opposed to organizations. This insurance typically covers things like identity theft, data recovery, cyber extortion, and fraud and scam protection. While most people tend to think of cybersecurity in terms of large businesses, it’s also important for smaller companies—and individuals—to take the appropriate steps to safeguard their data online.

With this growing interest in cybersecurity across the board, the cyber insurance market has grown rapidly in recent years. The increasing number of high-profile cyber incidents has also contributed to the growth of the market, as companies and individuals have become more concerned about the potential financial losses that can result from a cyber attack.

The market is rapidly evolving, with new products and services being introduced on a regular basis. Some of the most common types of cyber insurance currently available include first-party coverage, third-party coverage, and network security and privacy liability. Some cyber insurance policies also include coverage for business interruption, crisis management, and cyber extortion.

One trend in the cyber insurance market is the increasing demand for “cyber-as-a-service” products, which offer a range of cybersecurity services in addition to insurance coverage. This can include things like threat intelligence, incident response, and vulnerability assessments.

Questions?

We can help! Talk to the Trava Team and see how we can assist you with your cybersecurity needs.

What Does Cyber Insurance Cover

So what is cyber insurance? Essentially, cyber insurance is designed to protect individuals and businesses from the costs and penalties associated with cyber attacks. What does cyber insurance cover? What’s covered under cyber insurance depends heavily on the plan and who’s being covered. Generally speaking, however, there are some things you can expect with just about any policy. These include:

- Loss or damage to data, systems, and networks

- Business interruption and loss of income resulting from a cyber incident

- Liability for data breaches or failure to protect sensitive information

- Costs associated with restoring and recovering systems and data

Becoming familiar with cyber insurance benefits, as well as cyber insurance requirements, can help you find the plan that’s right for you or your business. You might also download a cyber insurance PDF for a more extensive look into the specifics of a certain policy.

What Does Cyber Insurance Not Cover

What is cyber liability insurance? In a nutshell, cyber liability insurance refers to the type of insurance that organizations and individuals purchase to cover the costs of data breaches and attacks. So what does cyber insurance not cover? Typically, the following:

- Loss or damage caused by war, nuclear incidents, or government action

- Loss or damage caused by criminal activity by the policyholder or an employee of the policyholder

- Loss or damage caused by dishonest, fraudulent, or criminal acts committed by the policyholder or an employee of the policyholder

- Loss or damage caused by the failure to comply with laws or regulations

- Loss or damage caused by the failure to follow manufacturer’s instructions or industry standards

- Loss or damage caused by the failure to maintain adequate security measures or to update security measures

- Loss or damage caused by the failure to perform regular backups or testing of backups

- Loss or damage caused by certain types of data, such as data that is illegal or that is used for illegal activities.

- Some policies may not cover certain types of data breaches or attacks, such as nation-state attacks, and may require the policyholder to meet certain conditions in order to be eligible for coverage.

As with most types of insurance, different cyber insurance companies offer different types of coverage. For this reason, it’s important to do your research, shop around, and thoroughly explore your options before making a final decision.

When it comes to cyber security business insurance, you want to look for a policy that’s designed for your specific business type or industry. If you work in tech, for instance, you might have drastically different needs than someone that works in healthcare. Likewise, if you’re a large corporation, you’ll likely require more extensive coverage than a small company would.

Ultimately, no matter what type of cyber insurance you choose, you can rest easier knowing you’ll be covered in the event of a cyber attack. Cyber insurance benefits range from financial protection to compliance assistance—there really is something for everyone, and anyone can benefit from making themselves a little bit safer online.

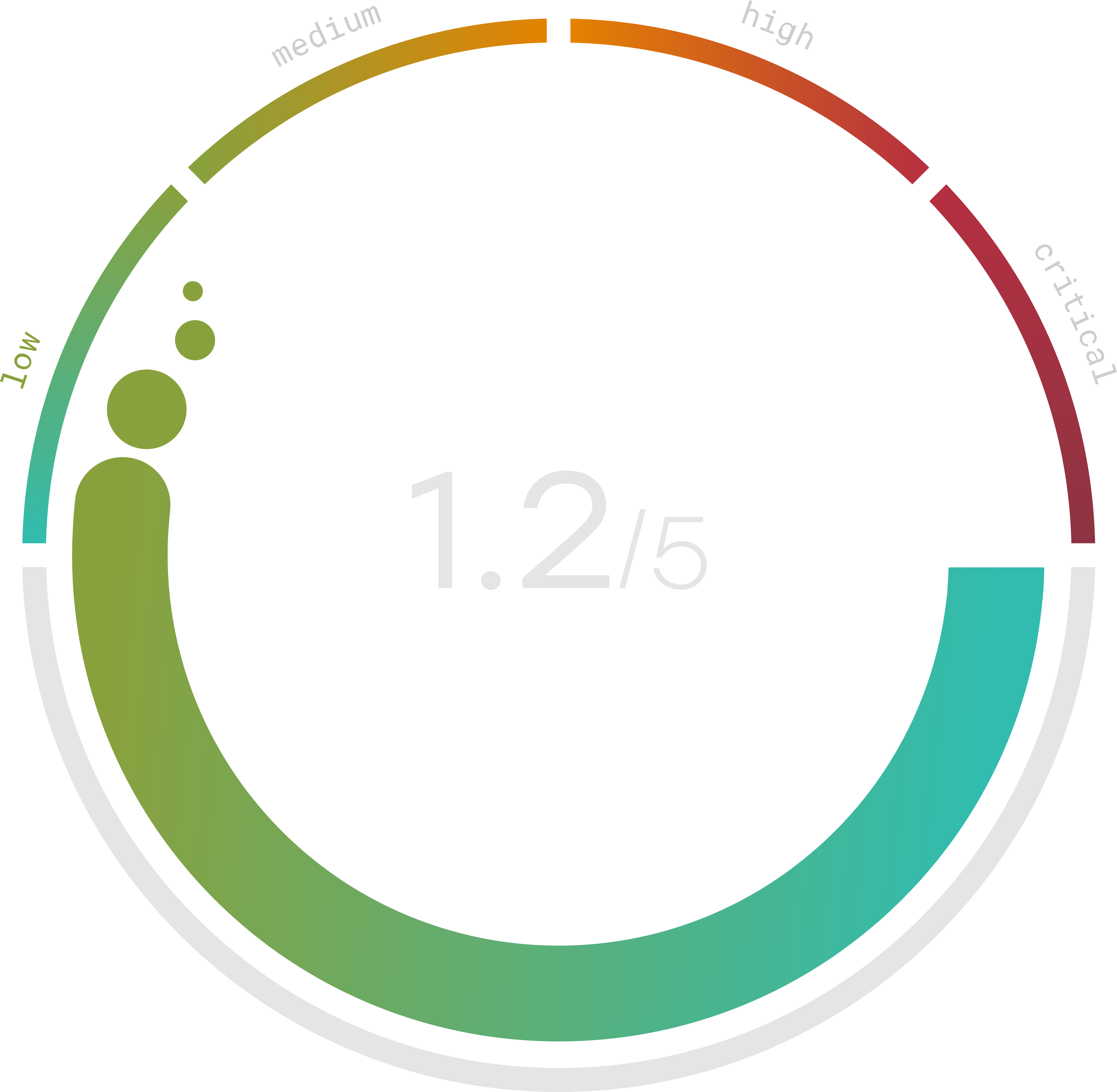

Do you know your Cyber Risk Score?

You can’t protect yourself from risks you don’t know about. Enter your website and receive a completely free risk assessment score along with helpful information delivered instantly to your inbox.

Cyber Security Insurance Requirements

Cyber security insurance requirements vary based on a number of factors. It can be helpful to view a cyber insurance policy sample to get a better idea of what these requirements entail and how they pertain to different types of policyholders. You can also download a cyber insurance PDF from your provider for a brief overview of the policy in question, or Google “cyber insurance requirements 2022” to see a list of updated requirements.

The following cyber insurance coverage checklist includes some of the key requirements included in most plans today:

- A thorough risk assessment to identify potential vulnerabilities and threats to the company’s digital assets.

- Implementation of security measures such as firewalls, intrusion detection systems, and encryption to protect against cyber attacks.

- Employee training programs to educate staff on how to identify and prevent cyber attacks.

- An incident response plan to address and manage cyber attacks, including procedures for containing and restoring affected systems.

- Regular security audits to keep security measures effective and up to date.

- Vendor management processes to ensure third-party vendors also maintain adequate security measures.

- Compliance with relevant laws and regulations related to cyber security such as HIPAA, PCI-DSS and GDPR.

- Insurance coverage limits, including the maximum amount that can be claimed for damages.

- Acceptable levels of deductibles and retention as part of the insurance policy.

- Business information such as type, size, and number of employees.

By positioning your business to align with cybersecurity best practices, you can more easily find a policy that works for your organization. Not all cyber liability insurance coverage is right for all types of businesses, which is why it’s important to do your research ahead of time. Cyber insurance benefits can make the effort worthwhile for your company.

Cyber Insurance For Small Businesses

Cyber insurance for small businesses typically differs from that for larger companies in a few key ways:

- Coverage limits: Small businesses often have lower coverage limits compared to larger companies. This is because the overall risk and potential financial losses are typically lower for smaller businesses.

- Premiums: Cyber liability insurance cost and expenses are lower than those of bigger companies. This is because smaller businesses don’t have as great of risk for cyber attacks and are less likely to suffer crippling financial losses.

- Tailored coverage: Small organizations often have more tailored coverage options available to them. For example, smaller businesses may only need coverage for data breaches, while larger companies may require coverage for a wider range of cyber threats such as network failures, business interruption and extortion.

- Education and resources: Many policies for small businesses come with educational resources, such as risk assessments, incident response plans, and employee training resources. This can be especially helpful for owners that lack the same level of experience or expertise in cyber security as larger companies.

It’s important for small business owners to understand their specific cyber risks and tailor their coverage accordingly. It’s also important for them to work with their insurance provider to understand the terms of their policy and ensure they have the right coverage in place to protect their business.

Researching the various types of cyber insurance and reaching out to receive cyber insurance quotes can help you make an informed decision and get a better idea of what’s available to you. While shopping for insurance can be stressful, you can simplify the process by outlining your needs. This can help ensure you find exactly what you’re looking for.

Trava provides helpful cybersecurity solutions for small businesses, allowing owners to take a step back and view their security programs from a holistic angle. By doing so, small companies can assess where they stand in terms of cybersecurity and what they could be doing better to improve outcomes. Businesses can also take advantage of Trava’s free cyber risk assessment for a quick overview of their current level of risk.