The History of Cyber Insurance

The cybersecurity insurance industry is a relatively new one. Cyber insurance has its roots in errors and omissions insurance, a form of insurance that covers companies against faults and defects in their services.

What is Typical Cyber Insurance Coverage?

What does cyber insurance cover?

The typical cyber insurance coverage pays for various cybersecurity costs, such as technical fixes, preventative measures, and reputational damage. A good cyber insurance policy covers monitoring and notification, data restoration, business disruption, liability costs, IT services recovery, investigation coverage, employee education, and public relations.

What does cyber insurance not cover?

Cyber insurance does not cover opportunity costs or lost profits, theft of intellectual property that results in significant expenses or diminished value, or costs associated with upgrading your security system following a breach.

How Much Cyber Insurance Do I Need?

What is the recommended level of insurance coverage?” Insurance brokers are often asked this question. It’s not as easy as it seems to answer this question. Depending on how many sensitive records you store, you will need to purchase limits accordingly. To minimize the damage caused by a data breach, you should consider what type of data you collect and other tools you use.

The cost of cyber incidents is high. Small businesses can expect limits between $1 million and $3 million. You can expect limits over $3 million if you have a larger business. Having this information will help you make an informed decision regarding coverage, limits, and costs.

Questions?

We can help! Talk to the Trava Team and see how we can assist you with your cybersecurity needs.

Cyber Insurance Companies

Companies offering cyber insurance provide a specialty insurance product that protects businesses against Internet-based risks and more generally from information technology-related risks. A traditional commercial general liability policy typically excludes or at least does not specifically define risks of this type.

Insurers are increasingly buying IT security services alongside insurance products as they pay out on cyber-losses and as cyber threats change and develop. Moreover, insurers are actively partnering with IT security companies to develop cyber-insurance products, which are also in the early stages of development.

Additionally, cyber insurance offers enormous benefits if a large-scale breach occurs. Businesses can return to normal and reduce the need for government assistance by using insurance as a smooth funding mechanism for recovery after major losses.

The cost of premiums for cyber-security insurance is adjusted to reflect the size of the expected loss from the risk. In addition to preventing free-riding, this prevents concentrations of potential risk.

Cyber Insurance Brokers

Providing you and your clients with the right cyber policies is the focus of cyber insurance brokers. You can obtain adequate coverage with the help of these experts.

Cyber liability insurance isn’t available from every standard insurer who offers these policies. An insurance broker who specializes in cyber security coverage can often step in and help find specialized coverage to suit each client’s needs.

Cyber Insurance Market

According to Allied Market Research, in 2018 the global cyber insurance market was worth $4,852.19 million, and by 2026 it will be worth $28,602.10 million, a growth rate of 24.9%.

A growing number of cyber attacks have become more intense and frequent, posing a threat to individuals, organizations, and countries. Cyber insurance solutions have been adopted to address this threat. There are many negative impacts of cyber-attacks on businesses, including declining customer bases, disruption of business, regulatory fines, legal penalties, and damages to reputation.

Personal Cyber Insurance Companies

As an add-on to homeowners insurance, cyber insurance can cover a range of cybercrimes.

It covers the removal of viruses and reprogramming of computers, laptops, smartphones, tablets, Wi-Fi routers, smart home devices, and surveillance systems that have been attacked by cyberspace. In the case of cyberbullying, your insurance policy covers you for wrongful termination, disciplinary action from the school, temporary relocation expenses, temporary private tutoring, and lost wages as well as legal costs.

Ransomware attacks block your access to your personal information and demand a fee to regain control over it. Cyber extortion coverage helps you recover from these attacks. If your insurance company approves, you might receive assistance from experts who can help you regain your files and reimbursement for any ransom paid.

Data breach coverage can help cover the costs of loss, theft, or publication of personal information entrusted to you. For example, if your tablet contains buyer information and your tablet is stolen, you will be reimbursed for services to individuals that were affected by the data breach. Among the types of online fraud covered by this policy are identity theft, unauthorized transfers of funds, phishing schemes, and other types of fraud that result in direct financial losses.

Types of Cyber Insurance Instructions

Types of Cyber Insurance

There are many different types of cyber insurance policies, including personal cyber insurance coverage, first-party loss coverage, first-party expenses coverage, and third-party liability coverage, each with specific parameters – sub-limits, retention, etc.

In the event of an attack, first-party revenue is typically lost as a result of business interruption, whereas first-party expenses may include forensic or system-rebuilding services. If sensitive information has been compromised, third-party liability may cover expenses and legal fees for third parties, including customers, employees, and partners.

Next-generation cyber insurance reduces exposures and prevents incidents before they happen through pre-incident services.

Cyber Insurance Coverage Checklist

You should consider the following cyber risks when evaluating the adequacy of your current cyber coverage or when adding cyber coverage insurance:

- Ransomware: Since the outbreak of the pandemic, ransomware has grown significantly in impact on businesses.

- Funds Transfer Fraud (FTF): Using social engineering techniques such as phishing or business email compromise, funds transfer fraud (FTF) is one of the easiest ways to monetize cybercrime.

- Physical Risk: An attack on a medical organization’s network could endanger the patients being treated there, or a shutdown could occur at a manufacturing organization.

- Risk to Cloud Vendors: Companies that store company documents in the cloud may provide these companies with sensitive customer and employee information.

Privacy Liability Insurance

Almost all companies today face privacy liability, one of the most well-known cyber security risks. If a hacker gains access to a company’s network, he or she can steal any type of customer data, including personal information. Losses suffered by an organization due to a failure to protect sensitive, corporate or personal information in any format are covered by privacy liability insurance.

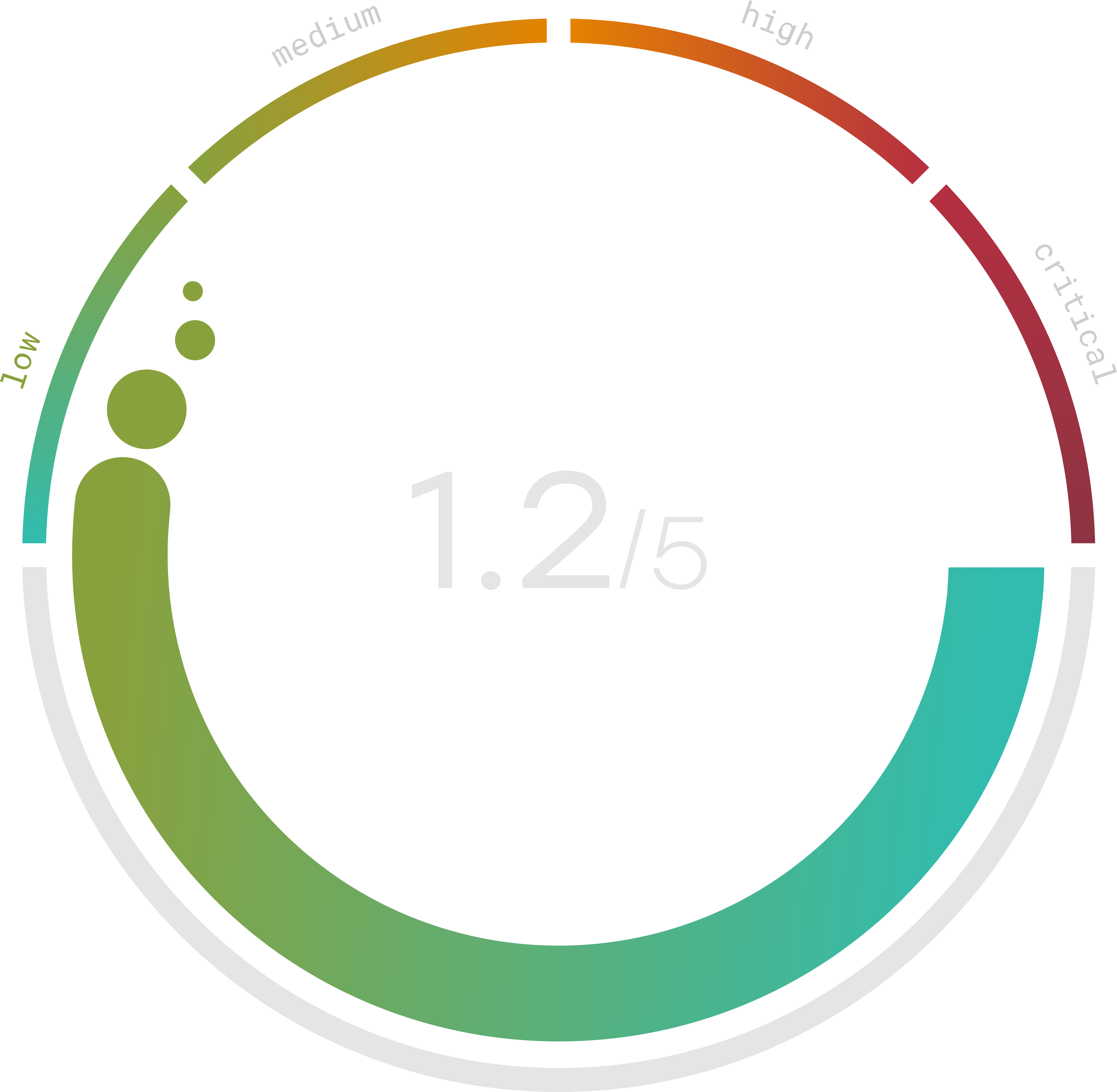

Do you know your Cyber Risk Score?

You can’t protect yourself from risks you don’t know about. Enter your website and receive a completely free risk assessment score along with helpful information delivered instantly to your inbox.

Cost of Cyber Insurance

Cost of Cyber Insurance

According to AdvisorSmith, “the average cost of cyber insurance in the U.S. is $1,485 per year or $124 per month. According to recent reports, the U.S. is the country most frequently targeted for cyberattacks. According to IBM, companies in the U.S. spend almost $4 million on average to respond to data breaches. For small businesses, the cost averages around $36,000 to recover from a data breach, according to First Data. For small and midsize businesses, the cost rises to an average of $86,000, as reported by Kaspersky.”

Cyber Insurance Cost Calculator

To assess your cybercrime risk, use a cyber insurance calculator. Identifying your business’ biggest threats can help you get started searching for the right cyber insurance.

Cyber Insurance 2022

As a result of the pandemic, cyber vulnerabilities in 2022 have grown, existing risk factors have been aggravated, and cybercriminals have become more aggressive in their attack techniques. Clearly, 2022 will be no different.

Cyber threats have prompted many large companies to ramp up their security budgets and deploy cutting-edge security technology. Although smaller businesses have fewer technological capabilities and smaller budgets, they are not defenseless. It is possible for business owners and their IT professionals to deter cyber-attacks by keeping up with changing risks and implementing basic countermeasures.

Cyber Insurance Policy Sample

Most cyber insurance providers can provide a cyber insurance policy sample so that you can assess and understand different aspects of your potential policy. Quite often, these are available from the provider’s website.

Cyber Security News

Security Magazine reported on new cybersecurity research showing that ransomware detections in Q1 2022 more than doubled from 2021. In Q1 2022, ransomware attacks exploded, despite a trend of declining attacks year-over-year in the Q4 2021 Internet Security Report. During Q1 2022, there were 2,365 detections of ransomware attacks as compared to 1,313 in 2021.

Cyber Insurance Market 2022

In its report titled, “Global Cyber Security Market Share, 2022-2029” Fortune Business Insights has projected that the “The Global Cyber Security Market Size is projected to reach USD 376.32 Billion by 2029, from 139.77 Billion in 2021, at a Compound Annual Growth Rate (CAGR) of 13.4% during the forecast period.”