The focus of SOC compliance is to provide assurance that a company’s internal controls are properly functioning and can achieve its objectives.

Every year, the risk that your organization experiences a security breach increases. The tactics and strategies of bad actors are becoming more and more complicated. When it comes to security, you cannot afford to leave things to chance. SOC compliance reporting is a vital element of maintaining data security. As more and more organizations begin to exploit outsourcing services as a way to become more efficient and grow their businesses, they become exposed to third-party risks. If you are a vendor of financial services, your clients will want to know that you have implemented the proper internal controls to keep their financial data safe. One way to demonstrate this to clients is to rely on SOC 1 compliance reporting.

What is SOC 1 compliance? It is a standard of compliance reporting defined by the American Institute of Certified Public Accountants (AICPA) that enables you to assess your company’s financial controls once and then report on that assessment to any stakeholders that may request it. Achieving SOC 1 compliance is a great way to prove that your organization can securely manage financial statements. There are two different types of SOC 1 reports, which we will dive into later in this guide. Furthermore, you should also be aware that there are several other SOC audits published by the AICPA, all of which can help increase the security of the data under your control.

The focus of this kind of compliance auditing is on internal controls. Internal controls are processes that your organization chooses to implement in order to mitigate certain risks. Examples of internal controls include segregation of duties, physical security controls, as well as security policies, and transaction reviews. Passing a SOC 1 audit and then delivering reports to current and potential clients can be a great way to get an edge over your competitors by demonstrating yourself as a more secure option for your customers’ outsourcing needs. In order to successfully pass a SOC 1 assessment, you’ll need to build a SOC-1 audit checklist of tasks and initiatives that will build and reinforce all the internal controls needed for SOC 1 compliance.

Questions?

We can help! Talk to the Trava Team and see how we can assist you with your cybersecurity needs.

SOC Compliance

SOC is an acronym for System and Organization Controls. The focus of SOC compliance is to provide assurance that a company’s internal controls are properly functioning and can achieve its objectives. One of the common misconceptions about SOC compliance is that it is some kind of certification or exam that requires specific actions before you can become “certified.” However, this is not how SOC compliance reporting works. Rather, an organization undergoes a SOC examination and is then issued a report by the Independent Service Auditor. This report will either contain an unmodified opinion or a qualified opinion. If the internal controls are effectively designed and implemented, an unmodified opinion will be delivered. This is usually the preferred outcome of a SOC compliance audit. On the other hand, a qualified or adverse opinion can indicate that issues have been identified with the internal controls or that you have left out important information in your description of your internal controls.

Although SOC reports can be useful for demonstrating the strength of your internal controls to management, investors, and auditors, a SOC 1 report is most commonly done due to a request from a client or customer. In this case, a third party is asking for evidence that you have the controls in place to keep their financial data and transactions safe. There are three main SOC compliance examinations – SOC 1, SOC 2, and SOC 3. At a high level, SOC 1 focuses on financial reporting controls, SOC 2 focuses on controls related to data security, while SOC 3 compliance requirements focus on similar elements to SOC 2 but generates a simpler, easy-to-read report.

One way to quickly become SOC compliant is to utilize a SOC compliance checklist. These are available online, but you should ensure that you are using a reputable source. Basically, they consist of a series of questions or tests that your systems and controls must successfully pass in order to be compliant. Although these checklists have no official bearing on your SOC reports, they can be helpful in identifying the practical areas that you can focus on in order to do well when the audit comes. One limitation of online checklists is that they are not customized to meet your specific situation. An excellent benefit of relying on a provider like Trava is that you can get access to an excellent SOC 1 compliance requirements checklist that will help you evaluate where you are on the SOC compliance journey.

SOC 1 VS SOC 2

We have mentioned the different elements that SOC 1 and SOC 2 focus on, but what is the difference when it comes to SOC 1 vs. SOC 2? For starters, SOC 1 reports are mainly used by and ideally suited for businesses that provide financial services. An example of this would be a business that provides payroll processing and management services. By contrast, SOC 2 has a broader and more comprehensive approach to security and applies to service organizations across a wide variety of industries. SOC 1 identifies whether or not a company’s financial controls are effectively implemented, while SOC 2 goes further. In addition to security, SOC 2 adds one or more of the AICPA’s five trust services principles – availability, confidentiality, integrity, and privacy. Both of these reports focus on internal controls and can be used externally and internally. Stakeholders within your organization, such as investors, may request a SOC audit to verify that the company’s controls are effective and compliant.

You can download SOC 1 report example PDF files online in order to learn more about the differences and similarities of SOC 1 vs SOC 2 vs SOC 3. When it comes to SOC reports, you should also remember that there are two types of reports (this applies to SOC 1 and SOC 2). SOC Type 1 reports provide a description of the implemented controls and demonstrate that they are correctly functioning at a given time. SOC Type 2 reports test controls over a minimum six-month period, showing that the implemented controls are not only correctly designed but operate effectively over a given period of time. For example, a SOC 1 Type 2 report would test a company’s internal financial reporting controls over a six-month period and then report on their operating effectiveness. Although a SOC Type 1 report is faster, a Type 2 report is more robust.

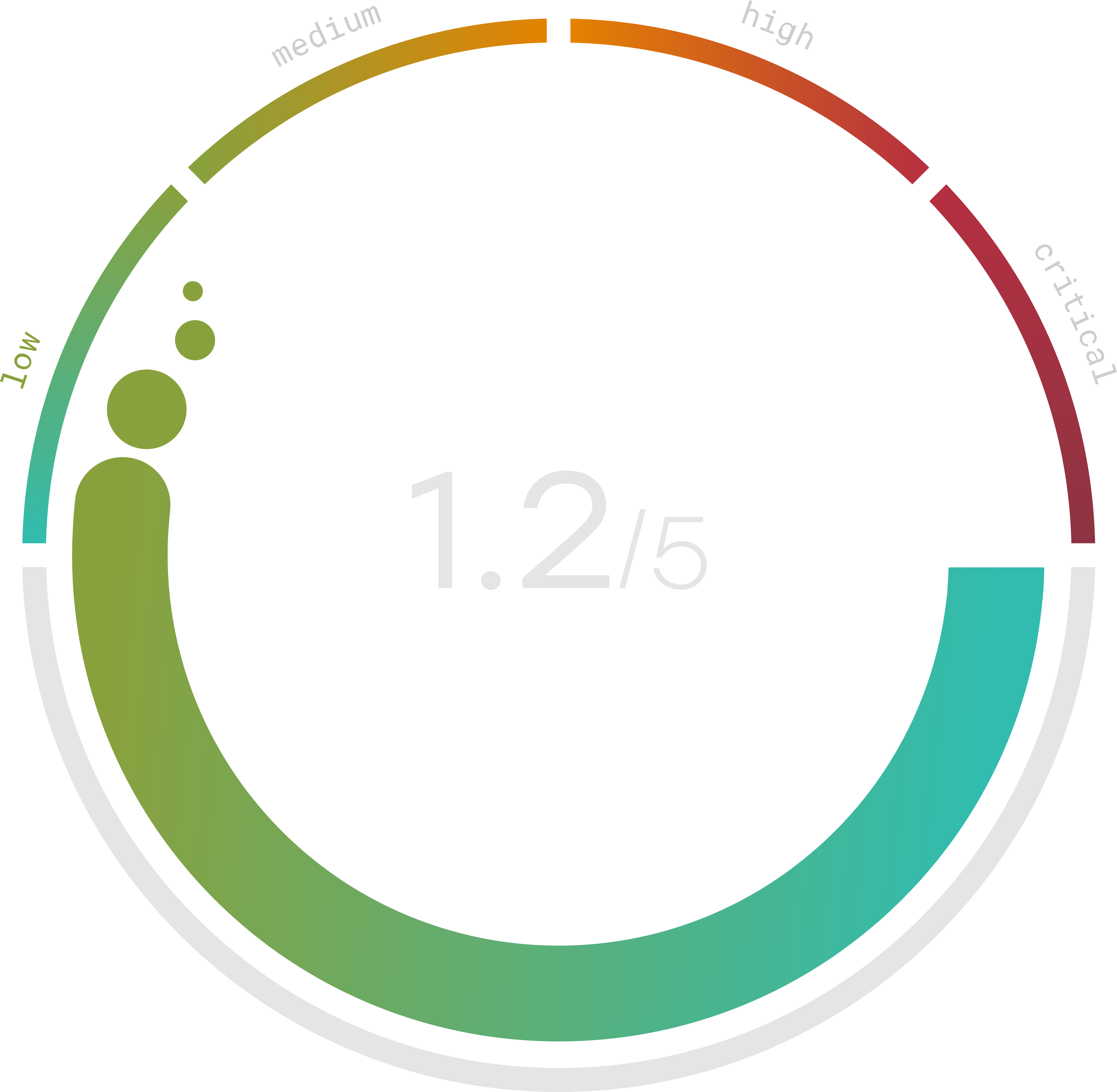

Do you know your Cyber Risk Score?

You can’t protect yourself from risks you don’t know about. Enter your website and receive a completely free risk assessment score along with helpful information delivered instantly to your inbox.

What Is SOC 1 And SOC 2 Compliance?

Because there aren’t any specific requirements for SOC 1, you may still be wondering, “what is SOC 1 and SOC 2 compliance?” From a practical perspective, SOC 1 compliance is a mechanism for demonstrating that your financial reporting is secure, while the SOC 2 compliance meaning is broader and attests that you have built effective controls to protect data throughout your organization. What does SOC 2 stand for? SOC 2 stands for Service Organization Control 2. It is the second standard after SOC 1 and also focuses on internal controls.

Before you can establish SOC 1 compliance, you’ll need a SOC 1 audit. The SOC 1 audit meaning refers to a process where your organization’s internal controls are evaluated, tested, and reported on. The audit will need to be conducted by an Independent Service Auditor. The auditor must be independent to prevent any conflicts of interest potentially interfering with the quality and trustworthiness of the SOC report.

SOC 1 compliance provides many benefits to your organization. Not only can you verify that you have taken the appropriate measures to keep your users’ financial data safe, but you can also uncover insights that inform you where to focus your cybersecurity efforts and reinforce your relationships with your clients, who will be glad to know that their financial data is secure.

SOC 1 Report

Although there is no real “SOC 1 certification,” receiving a positive SOC 1 report is not easy. There are many different controls that you need to ensure are in place and are properly functioning. Moreover, preparing for a SOC 1 report can be expensive. Some organizations spend tens or even hundreds of thousands of dollars preparing to successfully go through the auditing process. Whether you are going through an examination for a SOC 1 Type 1 report or a Type 2 report, it can be challenging to keep track of all the different elements that need to be correctly managed and implemented. Remember that you can always download a SOC 1 Type 2 report example PDF file online to get a better idea of what to prepare for and what you’ll receive as a result of successfully passing the audit.

Fortunately, you don’t have to go it alone. Trava Security can help you prepare for SOC audits, implement effective security measures, and achieve your compliance and cybersecurity goals. Trava also provides a vCISO (virtual Chief Information Security Officer) that offers all of the benefits of a human CISO employee at a fraction of the cost. A vCISO can be key to guiding your compliance efforts. Discover how a Trava vCISO can help you prepare for SOC 1 and other important compliance audits today.