What does it mean to have a risk management strategy? Does your company have a risk management strategy in place? Risk management is the process of controlling and minimizing threats to an organization’s capital and profits. It is crucial that every business should have a risk management strategy in place to mitigate the risks of external and internal threats to protect your company and ensure the security of your employees.

Before your company can grow and evolve, you must know or establish a risk management strategy. Having a risk management strategy will equip your organization with the knowledge of how to handle and respond to risks.

One risk management strategy example would be to educate employees about taking the proper measures to avoid the leaking of confidential information. This could be included in the onboarding process by making employees aware of the risk of leaving personal computers unattended within the workspace.

Another would be to inform organizational members to avoid opening suspicious emails with links that could potentially be phishing scams. Whatever risk strategy that your business has in place or decides to implement, it is essential to identify and monitor risks early on. Doing so will assist your management in taking the proper steps to contain and/or eliminate organizational risks.

This article will go over risk management strategy for your business, the process of risk management, 4 risk management strategies, and more. This article will help you to better understand the process of risk identification in project management and to discern the proper risk management strategies for your organization. For more in-depth information, download a risk management process pdf.

Questions?

We can help! Talk to the Trava Team and see how we can assist you with your cybersecurity needs.

Risk Management In Business

Businesses can only benefit from having a risk management strategy in place. With a risk management strategy in place, you will secure your company’s finances, operations, cybersecurity, reputation, and much more. But what exactly is considered business risk management? In what other ways can it help? Moving forward, we will discuss risk management in business and the impacts it can have on your organization.

To understand how risk management can help you and your business, it is crucial to understand what risks you can expect your business to face–both externally and internally. Internal risks refer to those that emerge from inside of an organization, such as employee shortages, human error, finances, technological issues resulting from obsolete software, and fraud. External risks encompass any threats from outside the organization that greatly impact the ability to operate, such as economic downturn, natural disasters, political disruptions, and more.

Formulating a proper risk management strategy for your business will best prepare you and your organization on how to manage and respond to both internal and external threats alike. Having a risk management strategy can help your organization to move forward with new projects by prioritizing specific risks associated with a given project. In the case a lawsuit arises, a risk management strategy can help prove due diligence and protect your organization’s liabilities.

Another benefit of implementing a risk management strategy for your business is the protection of resources. For example, implementing a health and safety program that addresses safety processes within the workplace, such as equipment safety, can reduce the likelihood of injury among employees. In turn, a risk management strategy can reduce lost time injury.

Having effective risk management in place for your business will also help to create a better image and reputation. A company that prioritizes the well-being of its employees and the safety of its organization will promote a reputation that is professional and cautious. Employees will have a better sense of expectation and leadership within an organization. For more information on the benefits of risk management in business, consult the following business risk management pdf. To obtain a better understanding of risk management for various projects, see the risk management in project management pdf.

What Is the Risk Management Process?

What is risk management process? As defined earlier within this article, risk management is the process of identifying, observing, and managing possible risks and threats of an organization to mitigate both internal and external risks. To be more specific, the process of risk management really boils down to decision-making that evaluates a multitude of factors and their associated risks, such as economic, social, and political factors.

The main goal of the risk management process is to evade certain risks or threats by developing a plan that takes into account certain factors that can evolve into potential risks or threats. This is achieved through the measuring and assessment of risk. Risk management strategies in business are developed to best fit managing certain risks.

Some might wonder where to apply risk management. Real life examples often apply to projects. For example, say that an organization is taking on a project where the scope is uncertain. Diving headfirst into a project where the scope size is unknown can backfire, especially if the project includes a large number of financial investments and labor.

A company that chooses to invest in a new and complex piece of software can either go two ways: the project is a success, or it will end up as not being a cost-effective decision, resulting in financial loss and wasted time. Some risk management strategy examples that can be taken by an organization prior to starting a high-risk project would be conducting formative research to identify costs and additional work. Risk responses should be sufficient enough to the impact of a given risk.

In risk management, there are 7 steps in the risk management process:

- Discern the context of the risk

- Next is to identify the risks or threats

- Identification and assessment of risks

- Treatment of the potential risk

- Creating the plan

- Implementation of the plan

- Evaluation of the plan.

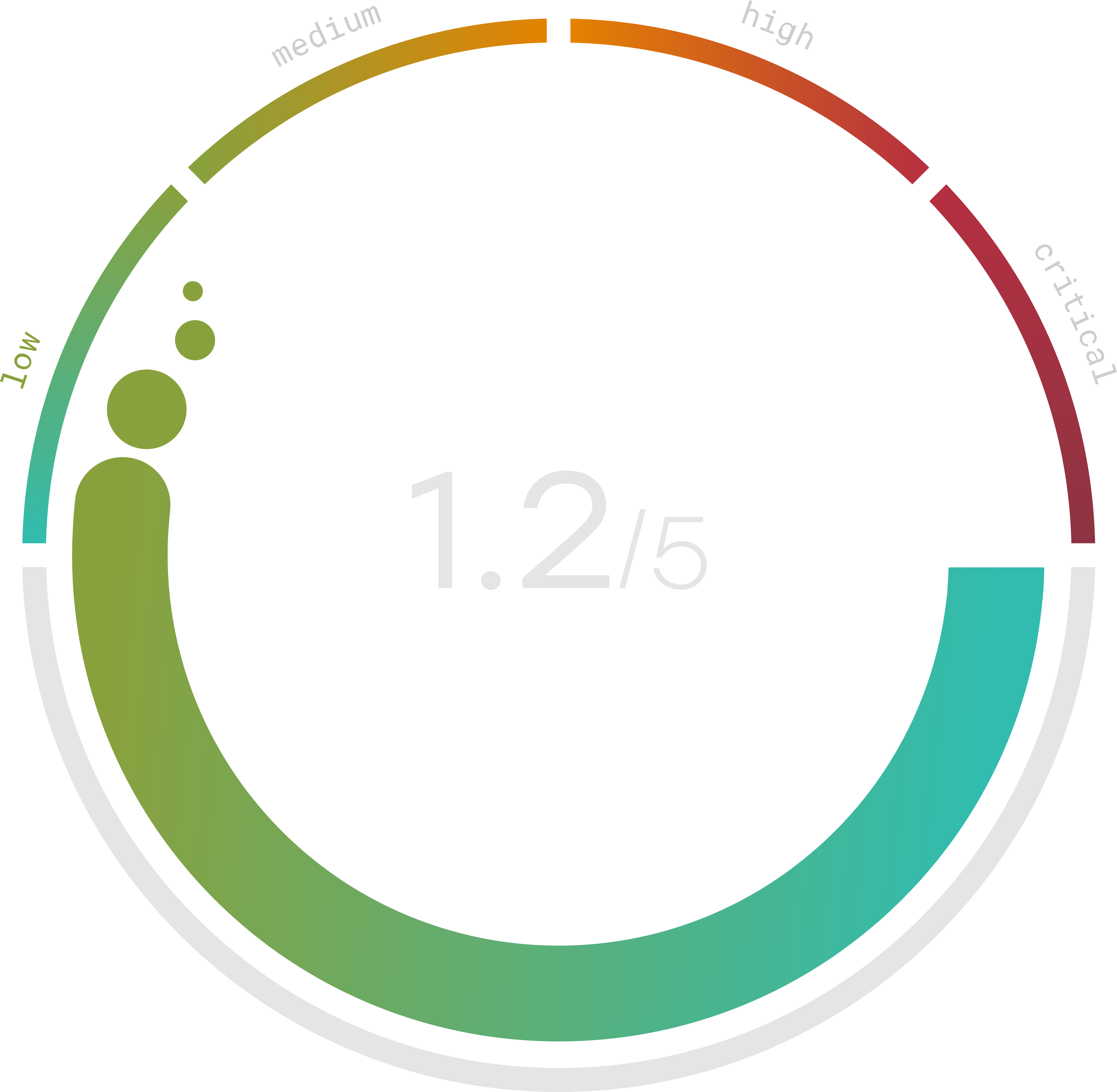

Do you know your Cyber Risk Score?

You can’t protect yourself from risks you don’t know about. Enter your website and receive a completely free risk assessment score along with helpful information delivered instantly to your inbox.

Risk Strategies

When responding to risks, there are 5 different types of risk management strategies: avoidance, retention, transferring, sharing, and loss prevention and reduction. These are also 5 methods of handling risk in insurance.

Avoidance is one method used for reducing risk by avoiding participation in activities that can cause illness, injury, and even death. A risk strategy example of this is encouraging employees to avoid opening any emails that could be phishing scams. Doing so dramatically reduces the risk of having confidential information or personal information stolen from an organization.

Retention refers to the acknowledgment of a risk’s existence, or in other words, simply accepting risk as it is. Accepting risk is usually done to prevent larger and more threatening risks that can emerge later on. An example of this would be taking on a health insurance plan with a high deductible rate. In this instance, the primary and accepted risk would be paying more money out of pocket. However, the risks of not having health insurance down the line are far more severe than the initial risk of financial loss.

Transferring risk is exactly how it sounds: passing a risk elsewhere. An example of this would be any type of insurance. If someone gets into a car accident where they are not at fault, the financial risk would be passed on to the insurance company of the person who is at fault for the accident.

Sharing risk is executed through employment benefits and the risk is shared with everyone in a given organization, such as health and life insurance plans. With more participants sharing a given risk, the lower the cost of premiums.

Strategies Of Risk Management

Risk management is crucial for protecting and maintaining the finances and profits of your organization. Typically, anything that is involved with the flow of finances into and out of the business is considered a financial risk. The key to understanding financial risk management is that it is not about avoiding risks, but rather about calculating and determining the necessary risks your company is willing to take.

Some examples of financial risks that businesses should be aware of are unemployment, higher expenses, debt and credit, and investments and assets. The process of financial risk management differs from the standard 7 steps of risk management process for businesses. These steps are identifying possible financial risks, analyzing the severity of financial risks, coming up with a strategy for managing these risks, and finally monitoring the efficacy of the given strategy.

The strategies of risk management are the same in financial contexts. Some financial risk management examples include avoiding credit card debt by refusing to use credit to make purchases. Another example of using strategies of risk management would be an organization transferring a risk, such as outstanding fines or theft, to a third party, such as a collection agency. For more insight on risk management strategies, consult the following risk management strategies pdf.

So, what methods should you choose to use when developing risk management strategies? Examples can include something like a cybersecurity risk assessment with Trava is one of the smartest moves you can make for your business. With the help of Trava Security, you can find out the strengths and weaknesses of your company’s security. To learn more, contact Trava today.

Sources

- https://corporatefinanceinstitute.com/resources/knowledge/other/financial-risk-management-strategies/

- https://smallbusiness.chron.com/benefits-gained-implementing-riskmanagement-program-75600.html

- https://simplicable.com/en/external-risk

- https://www.investopedia.com/ask/answers/050115/how-can-companies-reduce-internal-and-external-business-risk.asp

- https://www.indeed.com/career-advice/career-development/risks-business

- https://www.osler.com/en/resources/governance/2014/risk-management/6-benefits-of-a-risk-management-program

- https://reciprocity.com/resources/what-is-the-risk-management-process/

- https://thedigitalprojectmanager.com/project-risk-management-strategies/

- https://www.marketing91.com/risk-management-process/

- https://www.investopedia.com/articles/investing-strategy/082816/methods-handling-risk-quick-guide.asp