The Payment Card Industry Data Security Standard (PCI DSS) is a set of security protocols that mandates that companies handle credit card information securely. This standard is administered by the Payment Card Industry Security Standards Council (PCI SSC). The PCI DSS currently includes programs by five different card companies: Visa, MasterCard, American Express, Discover, and JCB.

The overall purpose of the PCI DSS is to ensure that merchants adhere to basic security requirements when storing and processing cardholder data. PCI DSS v4 is the current version of the standard, and it is important for businesses to become familiar with what this entails. The PCI SSC offers training programs so that businesses can obtain PCI DSS certification. You can download a PCI DSS PDF to learn more about these programs or more about the standard in general.

PCI SSC training and qualification programs include 3DS, Acquirer, Awareness, ASV, and more. These programs can be completed online, making them a great option for those that would like to move through the material at their own pace. You can learn at a time that is most convenient for you, acquiring the necessary skills to implement solid security measures. As the need for cybersecurity grows, it has become more important than ever for businesses to follow standards and guidelines.

Understanding the purpose behind the PCI DSS is critical for all companies that handle cardholder data. By maintaining a required level of security, they demonstrate to customers that they are willing and able to protect their information. This can help them avoid legal trouble and maintain a solid brand reputation. Completing a PCI DSS certification program is one of the best ways to learn about this standard and equip yourself with the skills you need to succeed with a number of data security protocols.

Questions?

We can help! Talk to the Trava Team and see how we can assist you with your cybersecurity needs.

What is PCI

So what is PCI? PCI stands for payment card industry and is most often referred to in the context of The Payment Card Industry Data Security Standard and Payment Card Industry Security Standards Council. Learning the PCI meaning and the history behind this standard can be helpful when getting started with a certification program.

There are 12 PCI DSS requirements to be aware of:

- Install and maintain a firewall configuration to protect cardholder data.

- Do not use vendor-supplied defaults for system passwords or other security parameters.

- Protect stored cardholder data.

- Encrypt transmission of cardholder data across open, public networks.

- Use and regularly update anti-virus software or programs.

- Develop and maintain secure systems and applications.

- Restrict access to cardholder data by business need-to-know.

- Assign a unique ID to each person with computer access.

- Restrict physical access to cardholder data.

- Track and monitor all access to network resources and cardholder data.

- Regularly test security systems and processes.

- Maintain a policy that addresses information security for all personnel.

PCI payment protocols are all ultimately designed to maintain security and protect sensitive information. When these requirements are followed, organizations can achieve robust security programs, assuring customers and business partners that they are taking the appropriate steps to safeguard their data. This is especially crucial for businesses that take card information online, as there are a myriad of ways that data can be exploited in the digital space.

While learning the ins and outs of PCI can be challenging, to say the least, it is vital to ensuring cardholder safety. For this reason, businesses may consider enrolling in a certification program to acquire the tools they need for compliance. Taking the time to become familiar with PCI is absolutely essential for any organization that handles cardholder data in any capacity.

PCI DSS

PCI DSS is a critical framework outlining a set of standards and protocols that businesses must follow when processing branded credit cards from major card schemes. The PCI DSS framework contains many components, and it’s important for businesses to become familiar with each of these in order to ensure compliance with the latest rules and regulations. Making an effort to remain compliant now can pay off in the future, allowing for greater business growth and helping to improve your brand reputation.

Making a PCI DSS compliance checklist is a great way to make sure you hit on all critical points in the framework. Some items you might include on a checklist are installing a firewall, encrypting data transmission, and enacting tools and software to protect against malware. Different businesses may be vulnerable to different types of risks, which is why you should consider your unique organizational needs and act accordingly.

As discussed previously, obtaining PCI certification is a great way to demonstrate your knowledge on the subject. In terms of how to get PCI DSS certification, you can enroll in a program through PCI’s website. The platform makes it easy for users to get started with certification and work through the material at a flexible pace. Becoming certified in PCI DSS can give you a leg up when it comes to actually implementing compliance policies.

It may be unnecessary for everyone in your organization to complete the training, but it’s a good idea to get them up to speed on some of the basics of the framework. This can help ensure that everyone stays on the same page and is familiar with the hows and why’s of PCI. Of course, those that work directly with cardholder data will need to go further in-depth on the subject and demonstrate a higher level of competence in maintaining the required standards.

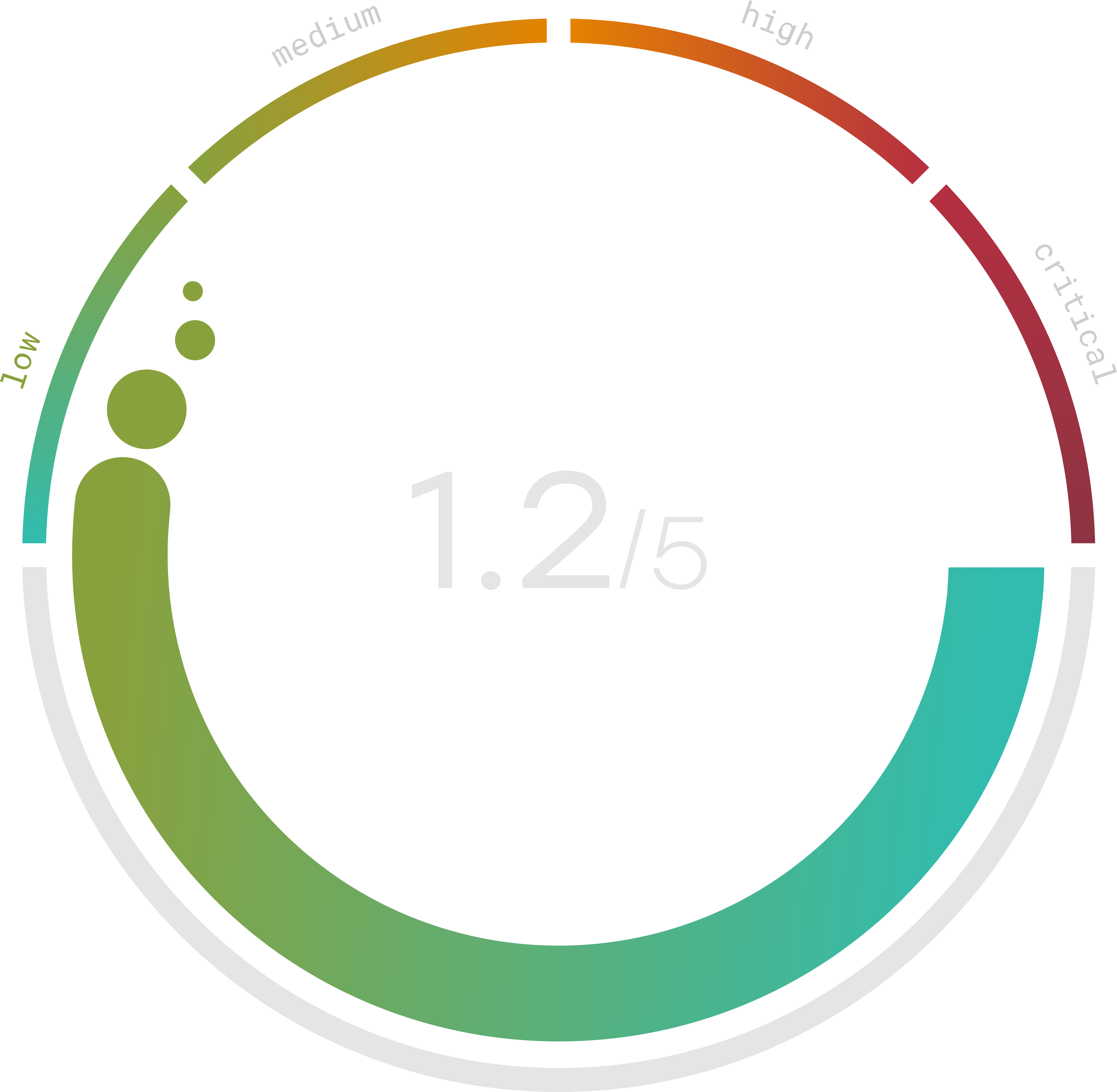

Do you know your Cyber Risk Score?

You can’t protect yourself from risks you don’t know about. Enter your website and receive a completely free risk assessment score along with helpful information delivered instantly to your inbox.

PCI Compliance

Maintaining PCI compliance is crucial for all businesses that handle credit cards. Cyber attacks are growing more sophisticated by the day. It has become more important than ever for organizations to invest in cybersecurity solutions and follow the required standards to protect sensitive data. Customers are becoming increasingly aware of cyber threats. They expect that those they do business with are taking the appropriate steps to secure their card information and prevent financial loss, identity theft, and more.

Adhering to the 12 key PCI compliance requirements is critical to maintaining the right security protocols. Still, PCI is just one standard that businesses are expected to follow when it comes to cardholder data. Companies should do their research and become familiar with whatever standards or regulations they fall within the scope of. Awareness is key to maintaining an effective security program, and because requirements are constantly changing, it’s important to stay up to date with the latest standards and guidelines.

There are four compliance levels that businesses should be aware of when it comes to PCI. They are as follows:

- Level 1: Applies to those that process over 6 million card transactions annually.

- Level 2: Applies to those that process 1-6 million transactions annually.

- Level 3: Applies to those that process 20,000-1 million transactions annually.

- Level 4: Applies to those that process fewer than 20,000 transactions each year.

These PCI compliance levels outline the standards that companies are expected to follow based on the number of card transactions they handle annually. Your PCI compliance checklist should account for the requirements at each level, as this can allow you to create a security program that’s more in line with the type of customers you work with, as well as the amount of transactions you process in a given period of time.

PCI DSS Cyber Security

Cybersecurity has become a hot topic among businesses across industries. This is unsurprising, considering the number of threats that abound in the digital space today. Standards like PCI have been enacted to ensure that the right security protocols are followed at all times. This offers greater peace of mind to consumers and helps businesses stay on track with their security programs.

PCI DSS cyber security standards outline clear and effective steps that organizations can take to fortify cardholder data and prevent the loss of sensitive information. The PCI security framework encompasses a wide range of critical elements of cybersecurity elements, allowing companies to cover all of their bases. By adhering to PCI data standards, you can significantly reduce the risk of a data breach, giving cardholders the peace of mind that their information is safe with you.

If you are just getting started with the framework, it can be helpful to complete a PCI certification program. Rather than attempting to learn everything on your own, you can access official materials from PCI’s website to ensure you absorb the information necessary to remain compliant with the standard. PCI certification programs can be completed online and are a great way to demonstrate your understanding of the topic.

Trava’s compliance solution makes it easy for businesses to stay on top of all required standards. While many organizations erroneously believe that they can rely on their in-house IT teams to manage compliance, the process takes an expertise that most businesses lack internally. By partnering with Trava, you can stay on top of compliance and make sure that you hit on all critical requirements. What’s more, Trava offers a free cyber risk assessment, giving you a score so that you can better understand where you currently stand in terms of cybersecurity and make a plan for improvement.