Cybersecurity insurance is a form of insurance that provides businesses with financial security when faced with the risks in a digital world, from cyber attacks to data breaches.

Cybersecurity almost seems to be a buzzword among companies recently. People are talking about the dramatic increase in cyber threats and the scary statistics left and right.

But cybersecurity insurance is not as often talked about. Yet, this is a crucial part of any business’s risk management program. No cybersecurity program can remove all your cyber risks. At some point, something is going to go wrong. Then what is your business going to do? You either have a cybersecurity insurance plan to fall back on, or your business is in trouble.

So, you need to invest in some cyber security insurance. This is a form of insurance that provides businesses with financial security when faced with the risks in a digital world, from cyber attacks to data breaches.

There are different types of cyber insurance that you could choose from, including first-party coverage, third-party coverage, and cybercrime costs. There are also many different cyber insurance companies you could use, and they each offer some alteration of the three types of cyber insurance.

But before you jump into choosing policies for your business you should consider the complex history of cyber insurance and the drastically changing landscape of the cyber insurance market 2022.

That data, along with knowledge of cyber security insurance coverage and benefits, should drive your decision-making as you look for the best insurance policy for your

Questions?

We can help! Talk to the Trava Team and see how we can assist you with your cybersecurity needs.

What Does Cyber Insurance Cover

To start, you need to know what an insurance policy can cover and what it doesn’t. With this information, you can structure your cyber security so it complements your cyber insurance policy—and you reduce your breach risk as much as possible. So, what does cyber insurance cover?

Cyber insurance has three possible areas of coverage: first-party coverage, third-party coverage, and cyber crime cost coverage.

First-party coverage is the most basic policy level you can get. This cyber insurance will typically cover the immediate effects of cyber attacks, including data recovery costs, court costs, customer reparations, and forensic specialist services. It also may provide for credit protection costs, PR services, and loss of income due to an interruption in services.

Third-party coverage will provide for costs related to the breach of personal information like social security numbers, bank account information, or personal health information. This coverage could also provide for third-party cybersecurity insurance claims—legal fees, fines, or claims for breach of contract or negligent protection of data.

There are some additional costs that a cyber security breach could cause, like direct cyber crime costs. So, insurance companies often provide additional coverage plans that cover cyber crime costs, including loss of funds due to digital theft or digital asset damage.

Unfortunately, cyber insurance will not cover all the potential risks your business could encounter.

What does cyber insurance not cover? If you upgrade your cyber security system after you have purchased a cyber insurance policy, your policy may not cover the new upgrades. You cannot make cyber claims to your insurance for profit loss after the breach either. For example, once your business is running after a cyber breach, you may suffer profit loss because your customers do not trust you. Most cyber insurance companies will not cover this profit loss.

An insurance policy also typically does not cover the loss of company value after some of your intellectual information has been stolen. Some policies will have underwritten exclusions as well, like not covering internal attacks or business interruptions from systems owned by a third party.

Cyber Insurance Market

When looking for cyber insurance, it is important to know something about the state of the cyber insurance market that you will be working in.

The cyber insurance market has been steadily hardening over the past couple of years. As cyberattacks readily increase, more and more companies have been making cyber insurance claims. This high demand has forced providers to limit what risks they will cover, hardening the cyber insurance market.

The global cyber insurance market has increased its premium rates as well—some rates were increased by 50% or more. This increase happened in all industries, including both cyber insurance for individuals and cyber insurance for enterprise companies.

Cyber insurance claims examples also show that insurance providers have limited their coverage. More and more insurance companies are adding exclusionary language for specific vulnerabilities, or they have revised their coverage terms to restrict how much risk businesses can transfer to their insurance.

But despite the market’s hardening, it is still growing. In the U.S., the cyber insurance market grew to $4.1 billion in direct written premiums in 2020. That is a 29% increase from the cyber market in 2019.

The combination of market growth and hardening makes the future of the cyber security market uncertain. However, cyber insurance underwriters will certainly be key players in guiding the market’s direction. If they continue to underwrite more conditions for policies, they will leave some of the cyber security risks with non-renewals. They will also define a company’s ability to transfer cyber risk to insurance in the future.

All in all, the market is rapidly changing as policies become more restrictive and rates steadily increase. You need to remember this as you search for insurance policies in this rapidly growing and hardening market.

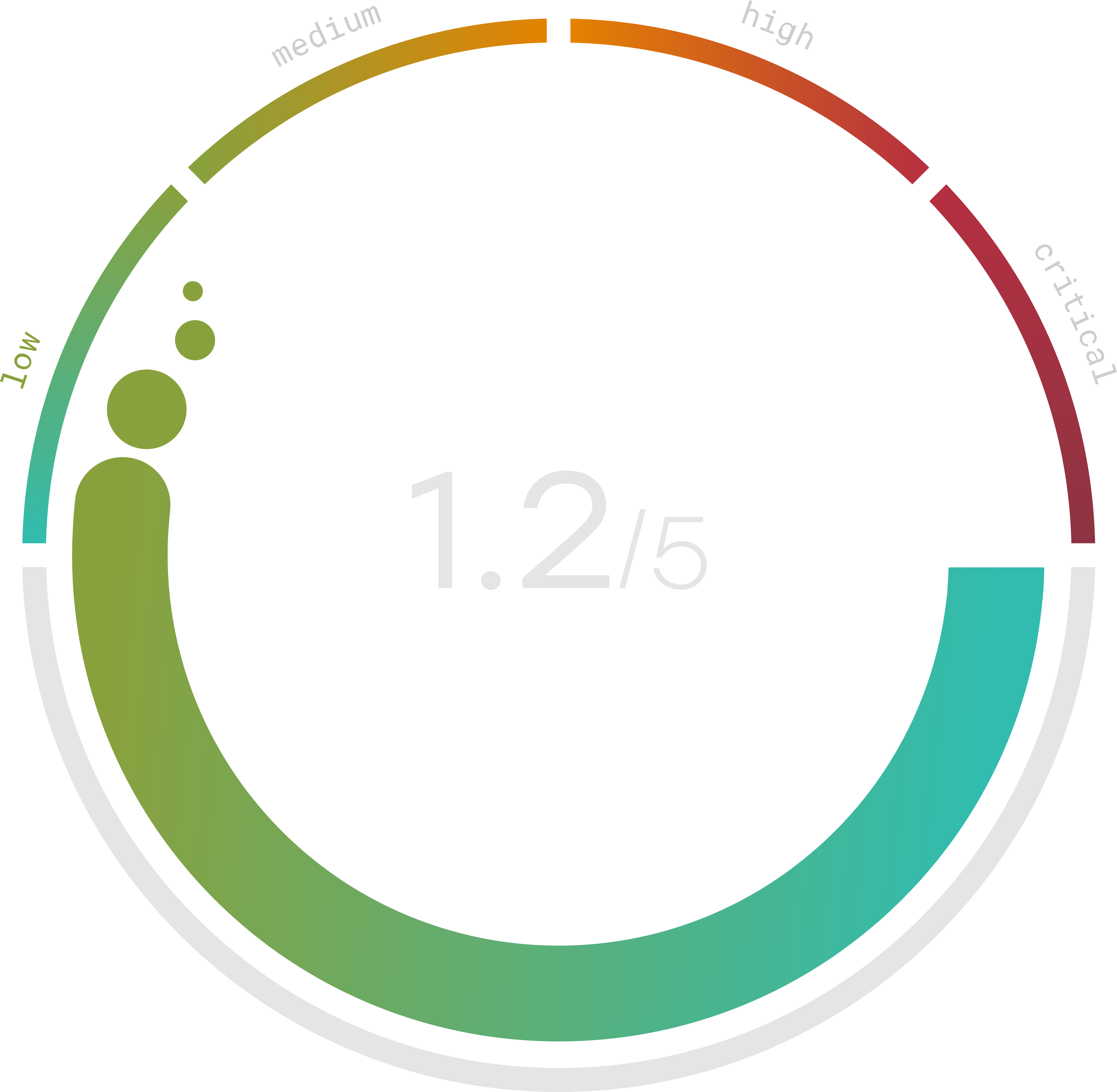

Do you know your Cyber Risk Score?

You can’t protect yourself from risks you don’t know about. Enter your website and receive a completely free risk assessment score along with helpful information delivered instantly to your inbox.

Cyber Insurance Benefits

Should you even bother to navigate the difficult cyber security insurance market? Is cyber insurance worth all the effort and time it takes to find it? Yes. There are so many cyber insurance benefits, and they are all well worth your effort.

Here are just some of the benefits of cyber insurance:

- Builds customer trust

- Offers legal support

- Prevents company bankruptcy due to cyber security breaches

- Covers first-part costs for cyber extortion

- Cover third-party insurance claim costs

- Could offer business interruption loss reimbursement

- Could provide data breach coverage

Of course, the benefits you receive from cyber insurance will fluctuate based on the policy that you choose. But no matter what level or type of insurance you get, they all come with the benefit of a cyber insurance claims process to cover some of your financial losses from cyber security breaches.

There are even more benefits of cybersecurity insurance for small businesses. In a report by Information Security Buzz, 55% of the small business leaders surveyed admitted that cybersecurity issues were regularly deprioritized in favor of other business activities. Additionally, a third of small businesses don’t have time to monitor every threat or alert.

Cyber security simply cannot be the top priority in a small business. So, they are at a higher risk for cyber attacks, which means they need insurance even more than large corporations do.

To make matters worse, nearly a quarter of small businesses in the UK are likely to go bankrupt if they had to deal with the average cost of a cyber attack.

Insurance can cover some of the cost of cyber attacks though. If cyber insurance for your business will make the difference between bankruptcy or survival after a cyber security breach, your small business needs cyber insurance. That is one huge benefit that cannot be ignored.

Cyber Liability Coverage

After learning all this information about cyber insurance, you should be ready to get cyber liability coverage or privacy liability insurance. It will protect your business from some of the costs of cyber threats and data breaches, and it may even save your small business from going under.

But you should not purchase just any cyber liability insurance. You need something that will cover your business sufficiently. So, you need to scrutinize the details of any cyber liability coverage you are considering. Some companies will sell policies that have exclusions or situational clauses that could prevent your small business from receiving a payout.

Below is a cyber insurance coverage checklist. These are things you want to ensure are included in your policy.

- Ransomware coverage

- Social engineering coverage

- Coverage of all data breaches

- Loss of income coverage for business interruptions

Wondering how to determine cyber insurance coverage? Talk with an insurance provider agent and ask direct questions about their policies. You can ask for information on their policy exclusions. You should also ask if their policies require your business to use certain data security tools or perform certain security practices.

Trava provides tools and assessments to help you evaluate your cybersecurity posture and potential risks. While we don’t sell insurance, understanding your risk profile can help you explore insurance options confidently.

Schedule a consultation with Trava to ensure your business meets compliance standards and is protected against cyber threats.

Sources

- https://www.forbes.com/advisor/business-insurance/cyber-liability-insurance/

- https://www.ajg.com/us/-/media/files/gallagher/us/cyber-insurance-market-conditions-january2022.pdf

- https://informationsecuritybuzz.com/study-research/4-3-million-uk-small-and-medium-sized-businesses-believe-they-are-vulnerable-to-cyber-attacks/

- https://informationsecuritybuzz.com/expert-comments/more-than-1m-small-businesses-at-risk-of-collapse-due-to-cyber-threats/

- https://travasecurity.com/learn-with-trava/blog/cyber-insurance-explained-who-what-why-and-how