Cyber liability insurance is a type of insurance designed to protect businesses against liability incurred by cyber crime. The cyber insurance market has grown substantially in recent years with the increased awareness of cyber safety. Without insurance, you may be responsible for whatever data breaches or related issues occur within the systems you use. For this reason, it’s important to find a good cyber liability insurance policy, especially if you work with large volumes of sensitive data. As is the case with any type of insurance, you don’t want to ever have to use it, but being caught without it when you actually need it is worse.

Cyber liability insurance cost varies depending on your specific business needs. Some policies can be purchased relatively inexpensively, but these don’t typically offer more than basic coverage. Bigger policies cover a wider range of risks and may be ideal for businesses that work with a lot of vulnerable data. To find the insurance plan that’s right for your business, you should outline your specific needs and where you see the biggest gaps in your current coverage. What types of risks pose the biggest threat to your digital systems? What measures, if any, do you already have in place to address these risks? Having cyber insurance explained to the rest of your team can help get them to start thinking about these things.

Trava helps insurance agencies provide better cyber coverage for their clients. Offering quick quoting and easy renewal, Trava enables insurance providers to up their game and leverage technology to account for multiple aspects of cybersecurity. With Trava, you can insure for the unknown, including stolen funds, lost income, and ransom payments. Trava helps businesses to assess risk, select the appropriate coverage, and more.

Questions?

We can help! Talk to the Trava Team and see how we can assist you with your cybersecurity needs.

Cyber Insurance Claims

Cyber insurance claims are made when affected parties take action to remedy whatever wrongs have occurred due to data breaches or other cyber failings. For example, in the event of a traveler’s insurance data breach, the victim would file a claim for whatever travel data was lost or compromised as a result of the breach. Viewing cyber liability claims examples can give you a better understanding of how claims work, how they are filed, and what victims can expect to receive should their claims be accepted. Businesses should gain a thorough understanding of the claims process in order to protect themselves and respond to the issues that do come up.

Browsing cyber media liability claims examples is a great way to understand cyber media liability and the type of claims that are filed when sensitive media files are compromised. Businesses that work with these kinds of files should know how to protect them and how to work with their insurance providers to resolve issues in a timely fashion. By preparing yourself for trouble ahead of time you will be better equipped to tackle the challenges that come your way. Your insurance provider will also be able to help you with your unique business needs.

Insurance providers typically work closely with clients when claims are filed, carefully examining the situation to see what happened and how it happened in order to determine whether those claims should be approved. However, understanding the ins and outs of your insurance policy ahead of time can make for a smoother process later on. When someone files a claim, you don’t want to make a bad situation worse, and so it’s important to know who to contact and how to go about remedying the situation when the need arises. This can promote business growth and customer retention and demonstrate to others that you are on top of your cybersecurity game.

Cyber Insurance Coverage Checklist

Making a cyber insurance coverage checklist can be extremely helpful when choosing a policy. There are a number of items you might include on your checklist, depending on your specific business needs and what you’re looking for in terms of cybersecurity coverage. Generally speaking, however, there are a few critical items you should include on your list, regardless of what you’re looking for on a more specific level. First, you should ensure that your plan covers forensic and investigative expenses. When a data breach occurs, you need to be able to get to the bottom of things to prevent something similar to prevent it from happening again, and investigative insurance can help you uncover the causes of these breaches.

Your checklist should also include legal fees—if a lawsuit is filed against your company, you want to have the best defense possible. In addition, you might consider placing public relations costs on your checklist. Big data breaches often make the news, and it’s important to repair your reputation in order to retain customers and foster healthy business relationships with your partners. Searching “cyber insurance requirements 2022” will bring up some additional items that you might consider including on your checklist.

A cyber insurance coverage comparison chart can also be helpful as you compare providers. Comparison charts outline the different items that are covered by each provider, as well as any extra features they offer. Once you’ve decided on a provider, or are close to choosing between a few, you might even create a cyber insurance presentation to explain the different policies to the rest of your team and gather their input on which one would be most valuable for your organization.

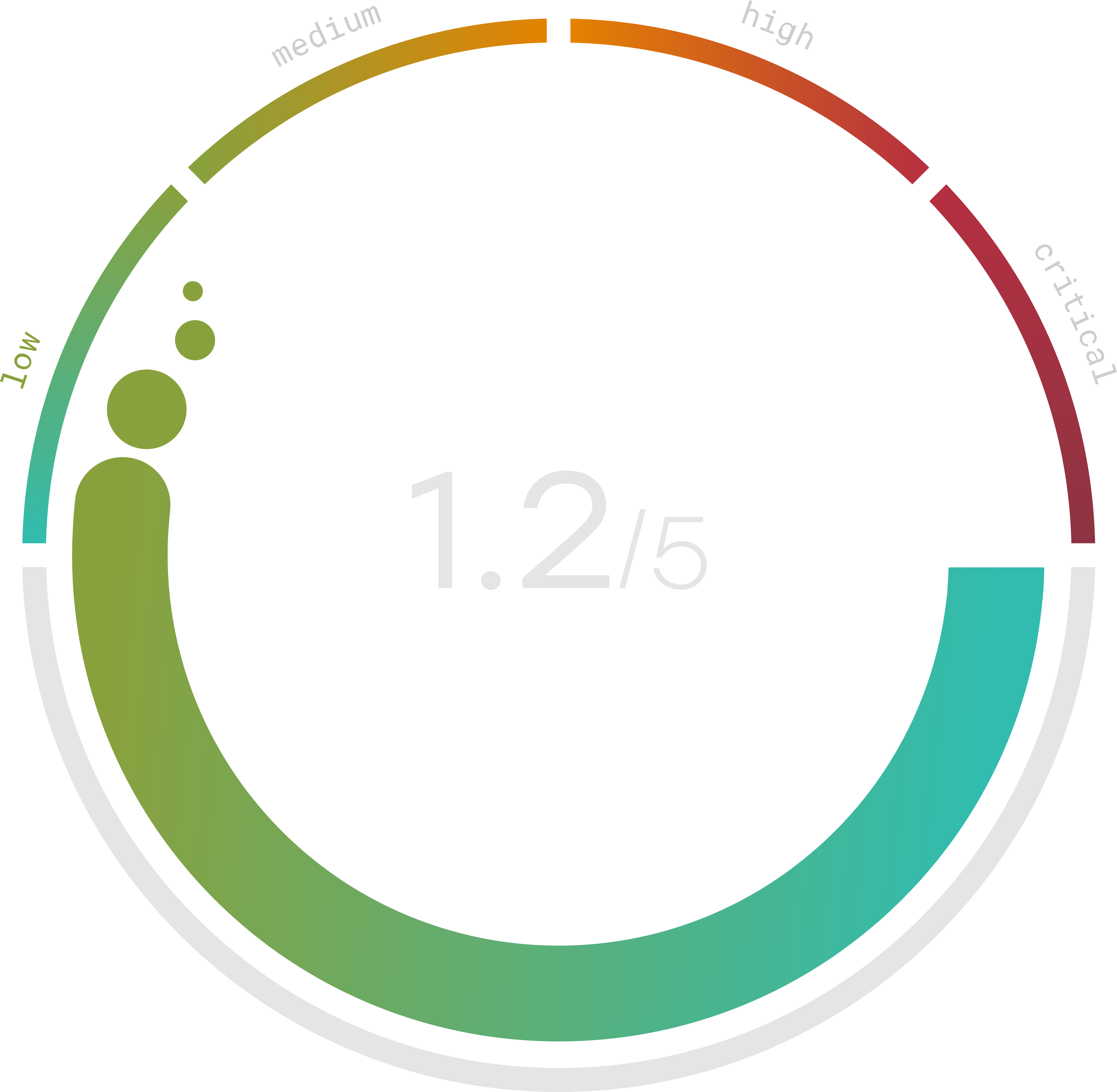

Do you know your Cyber Risk Score?

You can’t protect yourself from risks you don’t know about. Enter your website and receive a completely free risk assessment score along with helpful information delivered instantly to your inbox.

Cyber Liability Insurance For Small Business

Small businesses face a number of unique challenges, and this is true in terms of cybersecurity as well. Whereas larger organizations usually have the means to adequately protect themselves, smaller businesses often lack the expertise to manage their insurance on their own. If you are looking for cyber liability insurance for small businesses, it’s important to focus on providers that offer resources targeted specifically at smaller companies. This might include greater access to professional expertise, policy implementation services, or additional help with managing claims. Googling “cost of cyber insurance 2022” can give you a better idea of the cost of cyber insurance for small businesses today.

There are different types of cyber liability insurance for small companies, so you should thoroughly assess all of your options before making a final decision. For example, data breach insurance is designed specifically for data breaches and is among the most common—and crucial—forms of cyber insurance. Other insurance plans cover cybersecurity more robustly and, though not typically designed for small businesses with relatively straightforward cybersecurity measures, can be helpful for those that desire a little extra peace of mind. There is no one-size-fits-all solution when it comes to cyber insurance, and so whether you’re a large business, a small company, or anything in between, you should look for something that caters to your specific needs.

You should also be sure to choose a policy that allows for scalability. Your needs will likely evolve over time, especially if you’re a small business just breaking into the cyber insurance space, so it’s best to work with a provider that can address new needs as they arise. For example, as a small business, you may not currently require any sort of public relations coverage in your plan, but if your company were to grow and become more well-known, you may want the flexibility to add it to your policy.

Cyber Insurance Policy Sample

A cyber insurance policy sample can give you an idea of what to expect with a cyber insurance plan. For instance, if you want to learn more about cybersecurity clauses in contracts, you can look at a sample plan to see how each clause is worded. Cyber insurance policy wording varies between companies, so there isn’t necessarily one standard format for written plans. However, by taking note of a few key similarities between samples, you can get a general idea of how cyber insurance policies are worded and how this wording impacts readability—it’s important to choose a plan that you can easily understand.

You might also download a cyber insurance PDF for a quick overview of insurance policies. One of the great things about using PDFs is that they are accessible and can be easily distributed, making them a great resource for team sharing and collaboration. If there is a certain policy you are considering, you can access a PDF on that policy and send it to the rest of your team to help them understand what’s included in the policy and how it will be implemented. Additionally, by searching “cyber insurance requirements 2022,” you can learn more about cyber requirements in the modern age. This information can be useful when selecting a policy.

Cyber media liability claims examples demonstrate the importance of having insurance for cyber media. You can see what kinds of claims have been made and what steps insurance companies have taken to remedy the situation. This information can be extremely helpful when deciding between providers, as some go the extra mile to ensure that everything is taken care of promptly. At the end of the day, however, each business is unique, which is why it’s important to consider how each policy will impact your organization in particular.