Every company is unique technologically. Depending on the company’s infrastructure, some companies might need a more comprehensive policy, while others might want a less comprehensive policy. The importance of understanding why the organization needs cyber insurance, as well as what the policy covers, cannot be overstated. This cyber insurance coverage checklist will help you understand what a cyber insurance policy covers.

Forensic Expenses:

The term forensic expenses refer to the costs associated with investigating and eliminating threats. Security breach fees can also include the costs of hiring an IT professional, a forensic accountant, or other professional services. Understanding this is important in knowing what to look for in cyber insurance coverage.

Legal Expenses:

In the event of a data leak, legal expenses include defense and settlement costs.

Notification Expenses:

In the event of a data breach, notification expenses include the costs of notifying customers.

Regulatory Fines and Penalties:

A cyber insurance policy can cover fines and other regulatory fees associated with regulations such as GDPR or PCI DSS.

Credit Monitoring and ID Theft Repair:

The cost of recovering from identity theft is included in credit card monitoring and ID theft repair coverage. Cyber insurance can cover identity theft-related expenses for your customers.

Public Relations Expenses:

In the event of a cyberattack, the costs of hiring a PR firm to handle the crisis and the costs associated with implementing any strategies and recommendations they recommend can be covered by a cyber insurance policy.

Liability and Defense Costs:

Coverage for losses and potential defense costs for network security lawsuits are included in liability and defense costs.

Coverage for Various Types of Cyber Attacks:

Cyber insurance companies pay expenses associated with various types of cyber attacks that can include costs for withstanding attacks, such as ransomware, DDoS attacks, and social engineering campaigns, as well as ransom payments and business interruption losses. Beazley cyber insurance offers policies for various types of cyberattacks.

Data Restoration Coverage:

Costs associated with data restoration include recovering lost data and investigating the cause of a cyberattack or data breach.

Losses in Third-Party Systems:

Cyber insurance should cover potential lawsuits associated with cybersecurity attacks or data breaches that negatively affect a third party. Chubb cyber insurance has policies that cover losses in third-party systems.

Questions?

We can help! Talk to the Trava Team and see how we can assist you with your cybersecurity needs.

What is Cyber Insurance?

If you’re wondering, “What is Cyber Insurance?” It protects businesses against losses caused by covered events. Policies can vary in what’s covered, the cost of that coverage, and the terms, but cyber insurance can help businesses manage cyber risks and recover losses associated with attacks.

Cyber insurance overviews the risks and costs of cyber-attacks. Is cyber insurance required? This overview will help you assess the level of need for your company:

Insurance carriers may become insolvent if they cannot cover losses due to incorrect pricing. Creating policy prices and estimating the costs and risks of cyberattacks are challenges for cyber insurance companies.

To forecast risks and determine policy rates, insurance companies rely on data. Due to the relatively new nature of the cyber insurance market, not much data is available. A lack of good data makes it difficult for insurers to estimate policy costs accurately. Therefore, current cyber insurance costs may not accurately reflect the potential losses the insurers are covering or the risk they are taking on.

As cyber threats evolve, the risks organizations face also change. The same is true for cyber insurance for individuals. Consequently, insurers have a difficult time underwriting cyber policies and keeping up with cyber risks.

As a result, cyberattacks may quickly escalate from one company to many, leading to unpredictable losses. As an example, Russian hackers launched a cyberattack against Ukraine in 2017, which spread globally within hours. This attack resulted in billions of dollars worth of losses for U.S. companies.

How Does Cyber Insurance Work?

In essence, cyber insurance covers losses resulting from data breaches, whether they occur for individuals or businesses. The most common of these include phishing, identity theft, stalking, and social media hacking.

Although large corporations generally have firewalls to prevent cyber attacks, it’s not always possible for individuals. Additionally, many people are negligent when it comes to their online transactions, resulting in breaches and losses. The policy covers first-party losses, regulatory actions, crisis management, and liability claims resulting from cyber crimes.

If you have more questions about how does cyber insurance work, you can consult the following list which highlights what does cyber insurance cover and what does cyber insurance not cover:

What Does Cyber Insurance Cover:

- Theft of funds

- Cyberstalking/bullying

- Malware/data restoration costs

- Phishing

- Cyber extortion

- Identity theft

- Media liability claims

- Social media

- Unauthorized online transaction

- Email spoofing

- Data breach and privacy breach

What Does Cyber Insurance Not Cover:

- Losses incurred through cryptocurrency

- Fraudulent conduct

- Unauthorized collection of data

- Accessing restricted sites

- Cost of upgrading devices

Cyber Insurance Comparison

Cyber insurance policies do not use standardized ISO contracts, so each insurer’s policy differs. Furthermore, insurers are often permitted to manuscript endorsements in the specialty/excess & surplus lines market. As a result, cyber insurance comparison is difficult. Certain elements of cyber insurance policies are common. Thus, it is difficult to make a formal comparison.

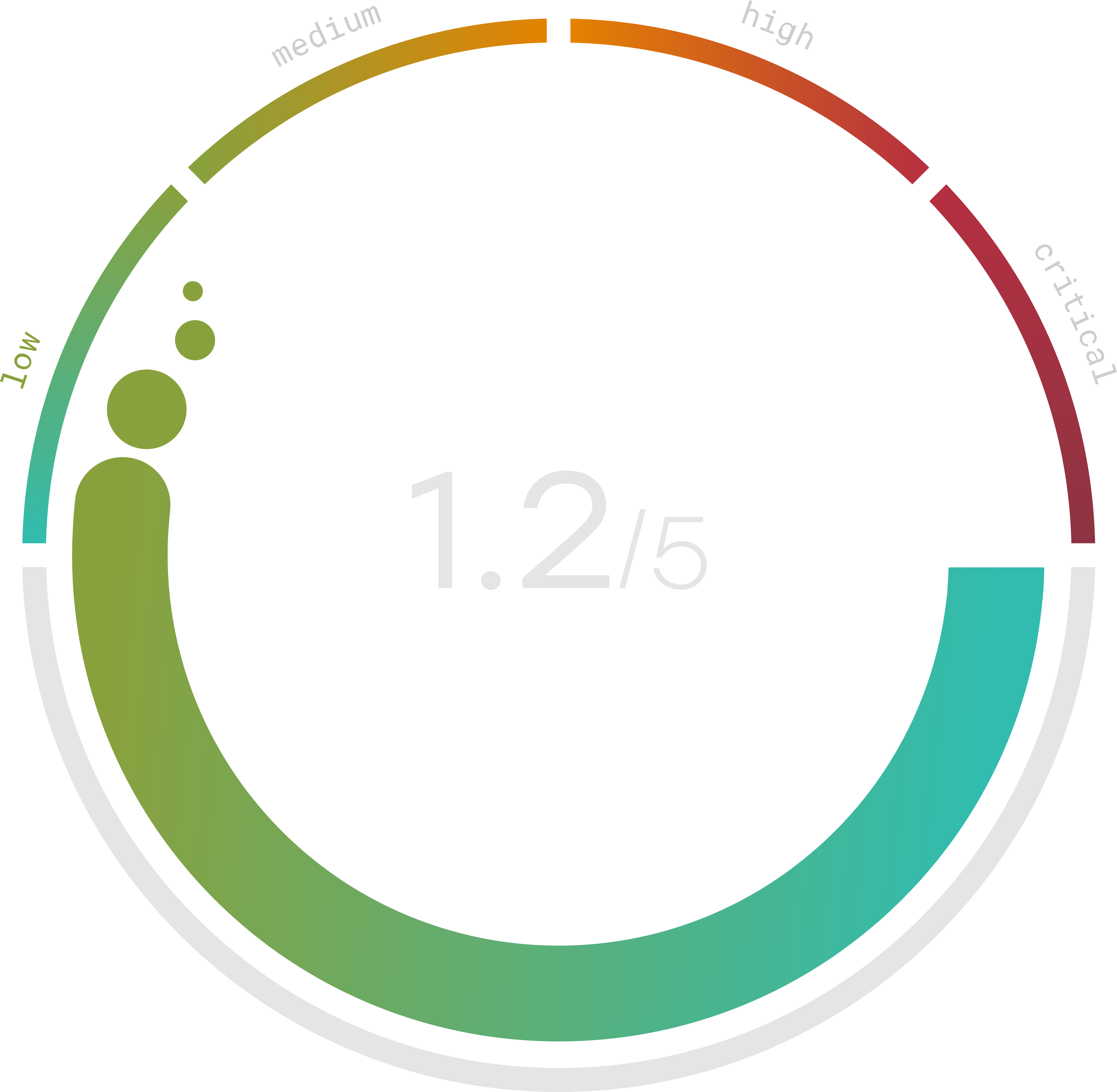

Do you know your Cyber Risk Score?

You can’t protect yourself from risks you don’t know about. Enter your website and receive a completely free risk assessment score along with helpful information delivered instantly to your inbox.

Cyber Insurance Requirements 2022

Cyberattacks in 2021 and in previous years have triggered significant changes in cyber insurance markets. The cyber insurance market has historically been considered soft. This resulted in lower premiums for firms. Cyber insurance has been hardened as a result of the exponential growth in adverse security events in the past year. Therefore, there have been tighter cyber insurance requirements. 2022 will have increased demand.

The following are some of the changes resulting from this hardened stance in cyber insurance:

- Demand for cyber insurance is on the rise

- Exclusions and terms that are tighter

- Premiums are on the rise

- Limits on cyber insurance coverage are being lowered

- Here are some steps you can take to minimize the increase in cyber insurance premiums

Need for Cyber Insurance

In 2022, you’ll see rate increases, capacity reductions, ransomware sub-limits, higher deductibles, and supplemental applications as the need for cyber insurance increases. Expect coverage to become significantly more expensive as cybercriminals continue to flourish and expand their attack scope. There is also likely to be increased underwriting scrutiny, as well as a somewhat tedious application process that includes a Ransomware Supplemental Application. Cyber insurance coverage is heavily reliant on your security controls, so it’s prudent to look at your cybersecurity as an aggregate rather than as individual elements.

Cyber Insurance Policy Sample

This cyber insurance policy sample explains how companies and organizations can protect themselves against:

- A liability claim arises when confidential or private information is released without authorization.

- A claim for infringement of privacy, copyright/trademark rights, or infringement of copyright/trademark rights through digital, online, or social media

- A claim alleging a failure in computer security that results in the deletion or alteration of data, the transmission of malicious code, or a denial of service.

- Costs of defense in state or federal regulatory proceedings involving privacy violations

- Assistance in handling the types of incidents listed above by providing expert resources and monetary reimbursement to the insured

What Items Should Be Included on aCyber Insurance Coverage Checklist?

- Privacy liability coverage

- Privacy regulatory claims coverage

- Security breach response coverage

- Security liability coverage

- Multimedia liability coverage

- Cyber extortion coverage

- Business income and digital asset restoration

- PCI-DSS assessment coverage

- Cyber deception coverage

Does Cyber Insurance Cover Ransomware?

Does cyber insurance cover ransomware? Ransomware and extortion threats are most prevalent in the U.S., according to Accenture data for 2022. Industries targeted include manufacturing, financial services, healthcare, and technology.

Since the pandemic, ransomware – also known as cyber extortion – has been on the rise. Due to the high levels of success achieved by ransomware, cybercriminals are leveraging this opportunity to hold businesses hostage, and businesses are looking for financial protection against ransomware attacks.

Ransomware insurance is not necessary for every business. Your resources may not be sufficient to cover the cost of this coverage, or you may feel well equipped to absorb this risk.

A small or medium-sized business may assume that it is less at risk for ransomware attacks than a large corporation. The times are changing, however, and that opinion is increasingly being proven wrong. According to multiple studies, smaller businesses are often more vulnerable to cyberattacks than larger enterprises, since they have fewer resources to invest in security measures and training, and thus are easy prey for cybercriminals.

The most vulnerable businesses tend to be those in professional services, health care, government, and retail.

For more information about protecting your business against ransomware and other cyber threats, search for “cyber insurance policy pdf” to look at examples.

Are You Looking for Cyber Insurance?

Trava Security can help you determine the right policy and coverage amount for your cyber insurance requirements 2022. Trava’s cyber quoting tool allows you to compare up to eight carriers quickly. Get a cyber insurance quote online by contacting a licensed agent. We offer free consultations on our cyber insurance products. Contact Trava today.

Sources

- https://nordpass.com/blog/cyber-insurance-coverage-checklist/

- https://www.gao.gov/blog/what-cyber-insurance,-and-why-it-high-demand

- https://economictimes.indiatimes.com/wealth/insure/other-risk-covers/do-you-need-to-get-a-personal-cyber-insurance-policy/articleshow/91031424.cms

- https://cpafma.org/articles/comparing-cyber-insurance-policies

- https://www.agileit.com/news/cyber-insurance-requirements-changing-2022/

- https://pro4.us/wp-content/uploads/Cyber-Sample-Policy.pdf

- https://www.crainsdetroit.com/sponsored-content/5-tools-help-protect-your-business-fraud

- https://advisorsmith.com/business-insurance/cyber-liability-insurance/ransomware-insurance/#do-i-need-it