If you’ve never considered the risk your business may face, you should start thinking about it now. Seriously, your business faces hundreds of risks each day, and if they are not avoided as best as possible, your business could be in serious trouble.

Take, for example, the cloud system that you may use to store data. It allows convenient access to information across your company, but it comes with the risk of hackers stealing sensitive data from your cloud and holding it for ransom, costing you millions.

However, with an understanding of the risk your company may face, you can take appropriate steps to reduce your risk and keep your company safe. That’s where risk assessment and management are helpful.

Company risk assessment is the process of analyzing the risk your company faces in operation every day. You might consider some common business risk examples and apply those to your unique situation to assess your risk. Then, for risk management, you work to avoid the risks to protect your finances, security, and privacy.

Risk assessment and management are crucial to your business’s success because they help you avoid things that could derail your business swiftly. You need risk assessment and management in entrepreneurship, small companies, and enterprise corporations.

How can you assess and manage your company’s risk? Keep reading to find out!

What Is a Risk Assessment

First, we need to establish some basic principles, like what is a risk assessment? In its most general form, a risk assessment is a process of identifying potential hazards and analyzing what could happen if a hazard were to occur.

Many different risks could affect a business, including the risk of natural disasters, human-caused hazards, or technological hazards. So, a risk assessment seeks to specifically identify those different risks and determine the consequences that those risks would bring to a business.

As a company risk assessment example, you could perform a detailed assessment of your cybersecurity system. This would probably involve scanning your system and other third-party applications for vulnerabilities. You might scan your external infrastructure, the Cloud, or your endpoint agent. Also, you could do penetration testing, where an ethical hacker tries to hack your system and reports on the vulnerabilities and other risks they found. After your system has been thoroughly scanned, you would compile a list of all the risks you found, and that would complete your risk assessment.

While that example does demonstrate how to do a risk assessment, there are many different ways to perform risk assessments depending on the type of risk your business is trying to assess. The next session will discuss those types of risk assessments in detail.

Questions?

We can help! Talk to the Trava Team and see how we can assist you with your cybersecurity needs.

Types of Risk Assessment

What types of risk assessment are available for your business? The Health and Safety Executive (HSE) identifies 3 main types of risk assessment.

- Large scale assessments are risk assessments performed for large and complex hazards, like the risks in the nuclear, and oil and gas industries. They often require quantitative risk assessments, which use objective data and some types of risk assessment matrix to determine precise risk scores.

- General assessments cover the full range of workplace risks, whether your employees risk injury or identity theft when at work. This type of risk assessment is often required under HSE, OSHA, and other safety and security administrations.

- Specific, required assessments refer to the risk assessments that are required under specific legislation or for certain accreditations. For example, HIPAA requires that healthcare organizations conduct a risk assessment to ensure that they’re compliant with the administrative, physical, and technical requirements.

Within each of these categories, your business has the opportunity to use qualitative risk assessments based, quantitative risk assessments, generic risk assessments, site-specific risk assessments, or dynamic risk assessments. So, you must decide what risk assessment is appropriate for your situation and for the type of risks that your business commonly faces.

Risk Management in Business

After performing one of those types of risk assessments, you cannot simply forget about your business’s risk. Risk assessments are just one step towards risk management in business.

What is risk management in business? It’s the process businesses use to find, assess, and control threats to the company’s financial security. With a risk assessment in a business plan, your company can find and assess its risks. But you also need to determine how to control those risks, which is where a risk management plan helps.

Risk management examples will look different in each company as there are several different types of risk management. Some companies will have large risk management teams that focus on cyber and safety risks and implement controls to eliminate those risks. However, smaller companies may only have one person that runs their entire risk management program. Or, they may assign cyber risk management to their IT department along with their regular responsibilities.

Risk management may involve three simple steps of finding, assessing, and controlling risk, or companies could have longer and more complex processes that they work through for their risk management.

But no matter what type of risk management a business uses, the principles behind risk management remain the same: the world is full of risks, and companies must try to lower their risk to protect themselves. So, for your company, you must try to avoid all the risks that you can to keep your company operating at its best. If the risks can’t be avoided, risk management might involve transferring risk, preventing loss from risk, or retaining the risk. But your company can’t just ignore the risks that you face every day. Take the right steps to implement a risk management plan for your business—especially for the ever-increasing cyber risks.

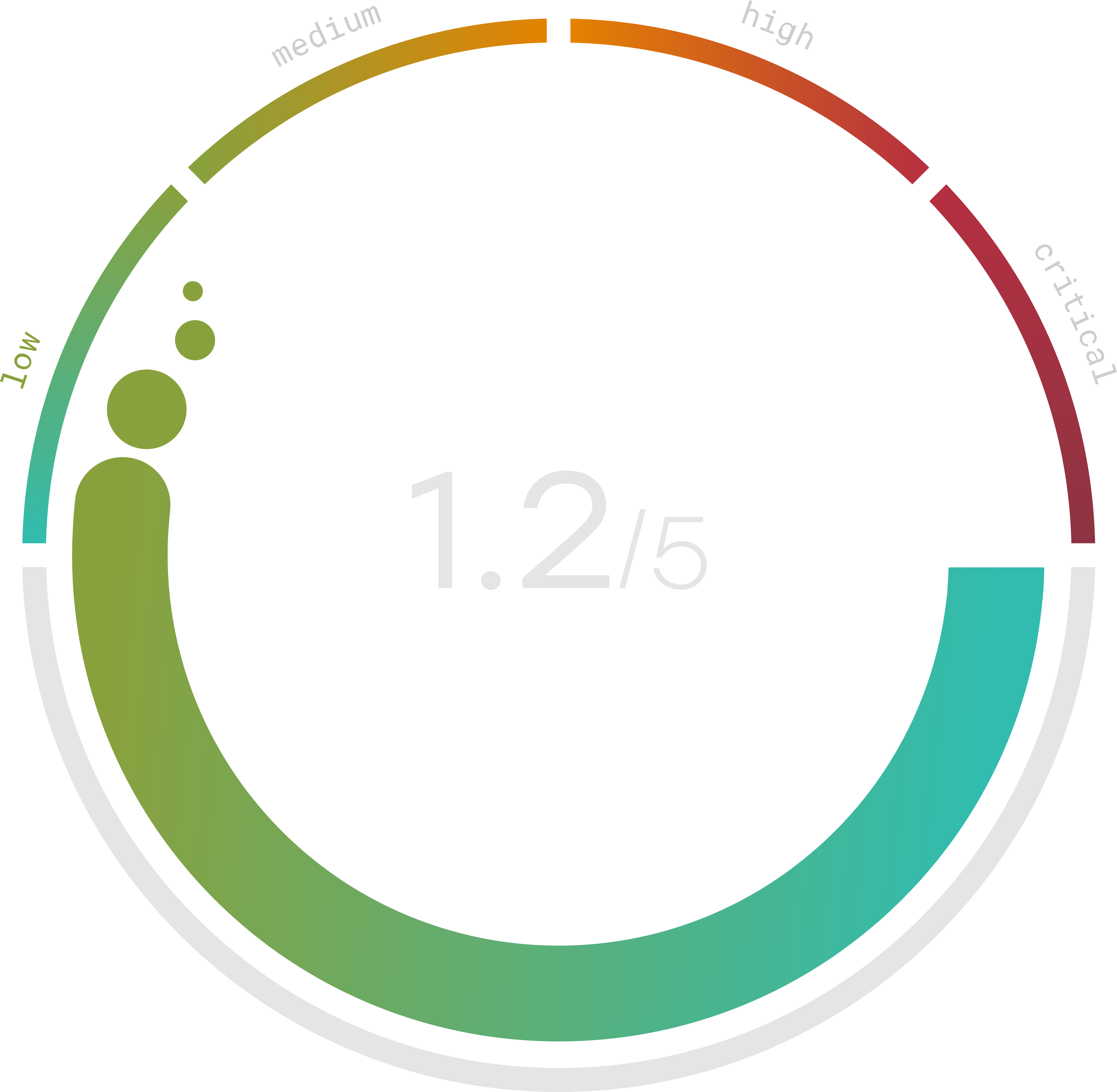

Do you know your Cyber Risk Score?

You can’t protect yourself from risks you don’t know about. Enter your website and receive a completely free risk assessment score along with helpful information delivered instantly to your inbox.

How to Manage Risk in Business

How can you implement risk management? While it’s important to control the risk your business may face, it can be more difficult to determine how to manage risk in business.

Fortunately, the NIST Risk Management Framework can help guide your business in managing risk while integrating security and privacy. It covers a 7-step process to risk management that can be applied to new or old technology systems within any type of organization.

- Prepare involves the essential activities that prepare an organization to manage security and privacy risks, like using different types of risk assessment tools.

- Categorize guides a business in labeling the sensitive information that they process, store, or transmit.

- Select is when an organization chooses the NIST SP 800-53 controls that will protect their system from risks.

- Implement involves establishing the NIST controls and documenting their implementation.

- Assess guides a business to determine if the controls are producing the desired results.

- Authorize is when a company decides to approve the system and the new controls.

- Monitor is an ongoing process where an organization monitors the controls and any risks to the system.

From this helpful framework, you can see what steps your organization will need to take to manage your risk, cyber or otherwise.

Business Risk Examples

What sorts of risks might your business need to assess and manage? Each business will face different specific risks depending on their industry and specific operations, but there are some generic business risk examples we can discuss, all involving some level of business risk and financial risk.

First, there are opportunity risk examples. Opportunity risk is the risk your business takes when you must choose one opportunity over others. When you can only choose one opportunity, you risk missing a better opportunity and getting an unexpected result. Some examples of opportunity risk include moving your business to a new location or selling a new product.

Your business probably also faces uncertainty-based risk. These are risks that arise from unexpected events. They are difficult to predict and even more difficult to mitigate. For example, fire damage, economic downturn causing financial loss, customer loss, or a decrease in market share because of new competitors are all examples of uncertainty-based risk.

You can also face cyber risk, an ever-expanding risk category as new technologies emerge, and hackers find new ways to exploit them. Your business faces cyber risks when doing anything online, with a Cloud, with email, or through several other technologies. You face the risk of phishing, malware, ransomware, data breaches, third-party attacks, compromised passwords, and much more—all of which can result in significant financial loss and overall business harm.

With those risk management examples in business, you should see the overwhelming need to protect your company from potential risks. And Trava Security is ready to help.

We provide comprehensive protection from cyber risks for small and medium-sized businesses. We offer several vulnerability scans and risk assessment surveys so you can know what cyber risks you are facing. After we have found your vulnerabilities, we can use advanced mitigation tools to repair your system’s weaknesses and secure your business for safe operation. But we don’t leave you with a secure system. We also offer cyber insurance so you can transfer your remaining risk to us and operate your business without fear of cyber risks.

Let’s manage your cyber risk together. Contact us today to get started.

Sources

- https://www.ready.gov/risk-assessment

- https://www.wgu.edu/blog/what-risk-management-business2003.html#close

- https://csrc.nist.gov/Projects/risk-management/about-rmf

- https://business.gov.au/risk-management/risk-assessment-and-planning/business-risks