Each year, companies around the world lose millions of dollars to cyber attacks. Research tells us that these attacks are only likely to increase in both frequency and sophistication. If your SaaS company does not yet have an actionable risk management plan, your assets, capital, and earnings could be lost.

When looking at the definition of risk management, we must first understand what a risk is. Simply put, the risk is anything that threatens a company’s bottom line. In the context of cybersecurity, we are talking about threats both from within and without your organization. Risk management is all about identifying these risks and developing strategies to address them.

If you look at any risk management plan example for business or any risk management plan template, you’ll see that the best risk management plans help an organization account for the entire range of risks that an organization faces.

There are four main types of business risk. The first is a strategic risk. This focuses mainly on risks to your company’s bottom line coming from the actions of outside organizations as they compete within the marketplace. The second is compliance risk. Compliance risk involves the possibility of financial losses as a result of failing to maintain compliance with all the relevant laws that govern the jurisdiction in that your business operates in. The third type of risk is operational risk. Operational risks involve the losses a company faces as a result of failures in the day-to-day operations of the company. It is in this category that cyber threats fall. For many reasons, cyber attacks are one of the most significant operational risks threatening your organization today. The final type of risk is reputational risk. This category of risk covers the losses that may negatively impact your company’s earnings in the event that public perception of your business is tarnished or degraded. Cyber attacks can also be classified as a major reputation risk.

Questions?

We can help! Talk to the Trava Team and see how we can assist you with your cybersecurity needs.

Risk Management Process

The risk management process can be divided into 7 steps.

- Define Goals

- Write Risk Management Plan

- Identify Risks

- Evaluate Risks

- Develop Mitigation Strategies

- Continuously Manage Plans

- Encourage Feedback

These are the 7 steps of the risk management process. The overall program starts with defining goals because it is vital to ensure that everyone is on the same page. Everyone on the team must understand the definition of success for the project. If you look at a risk management process for example, you’ll find that the second step is writing a formal risk management plan. The risk management plan is the place where you’ll store all the data, strategies, and techniques that will be gathered in the later stages of the project. The third element of the risk management plan steps is identification. Identification is the long and complex process of identifying and naming all possible risks to the organization. The goal is to ensure that your organization is not caught off guard by an unknown risk.

Once all risks are identified, the team will then need to evaluate the risks. This evaluation will include an analysis of the potential financial and reputational risks associated with the threat, along with the real-world likelihood that such a threat could actually occur to the company. This allows you to rank risks according to priority, enabling you to focus on what matters most. With your risks identified and evaluated, you can then move on to planning and continuous management. Here, you’ll create concrete strategies to mitigate or address each identified risk. Continuous management refers to the fact that no organization is static and you will need to continually return to your risk management plan and update it with both new risks and new mitigation strategies. Finally, feedback is critical as it enables you to understand how well your risk management strategies are working and what areas need improvement.

Risk Management In Business

When it comes to managing risk in business, there are four main types of risk management strategies:

- Risk Acceptance

- Risk Transference

- Risk Reduction

- Risk Avoidance

These are your four options for handling any particular risk. The first option, when faced with a risk, is to simply accept it. Risk acceptance means accepting a risk and taking no action to mitigate it. This approach does nothing to reduce the impact of a risk or prevent it from occurring. However, depending on how you have structured risk management in your business plan, this may sometimes be the best choice. For example, if the potential cost of a risk is only a few thousand dollars, it doesn’t make sense to spend $100K trying to mitigate it.

The second choice in the types of risk management is to adopt a risk transference strategy. Risk transference allows your organization to mitigate your risk by shifting the responsibility to another organization. Thus if you are faced with risks that your company wants to mitigate, you might opt to simply outsource the threatened processes, and rely on a third-party vendor to handle that risk.

The third option is to establish a risk reduction strategy to mitigate the risk. This is one of the most common ways of treating a risk and one of the most effective. With this approach, your organization takes action to mitigate risk using specific, actionable strategies. For example, if the risk of phishing is high in your organization, establishing a phishing training program is a risk-reduction strategy.

The fourth and final method is risk avoidance. In risk avoidance, the company simply abandons whatever activity that is creating the risk. Risk avoidance allows you to completely eliminate the possibility of a risk occurring, however, it can also limit your opportunities. That’s why many organizations only rely on risk avoidance for the most serious risks.

At the end of the day, your business will need to use a variety of risk management strategies in order to keep your operations running smoothly.

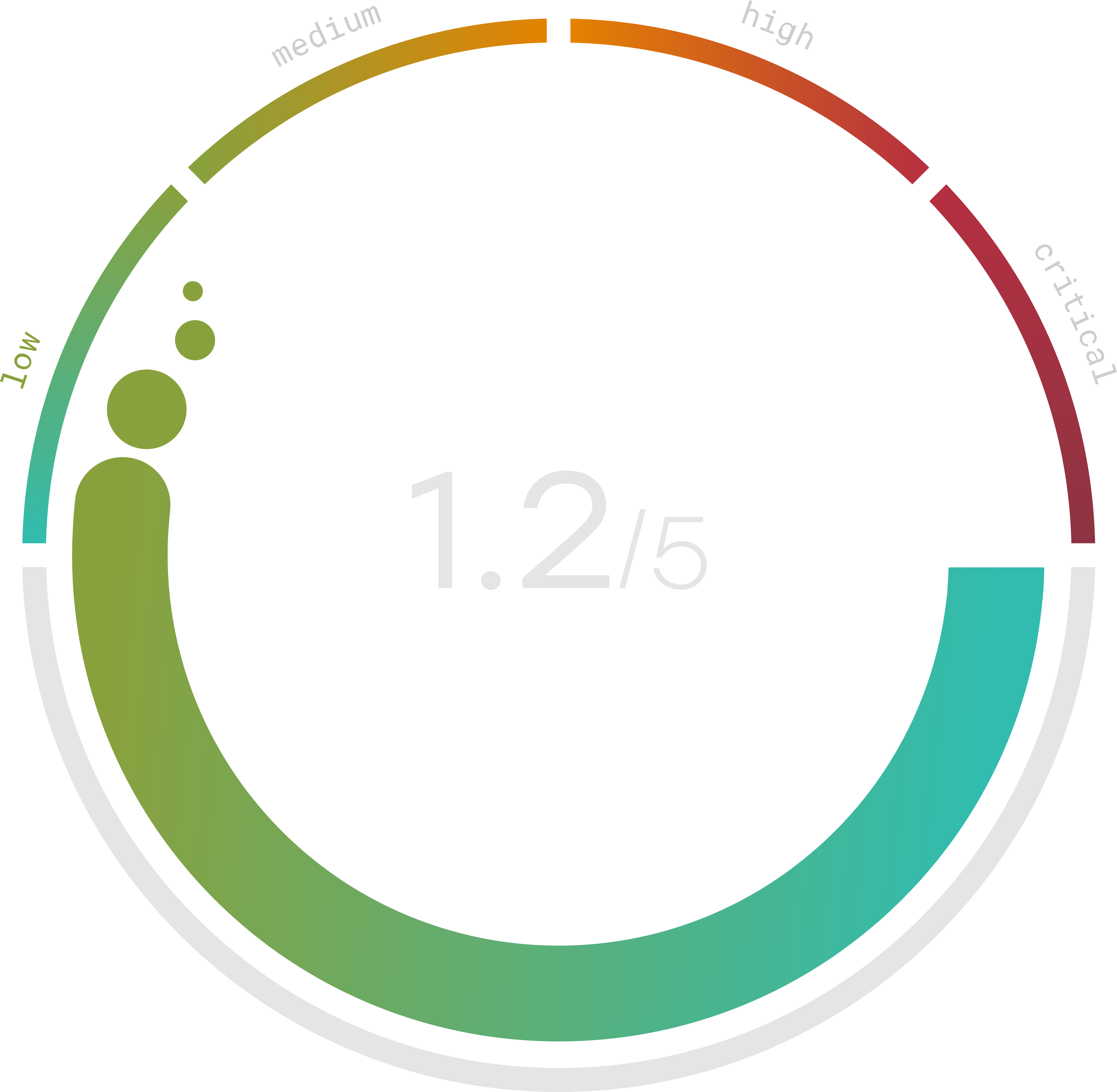

Do you know your Cyber Risk Score?

You can’t protect yourself from risks you don’t know about. Enter your website and receive a completely free risk assessment score along with helpful information delivered instantly to your inbox.

Risk Management In Project Management

In order to successfully execute risk management in project management, you need to be able to answer the question, what is the risk management process? It is also important to consider risk management in project management. It is easy to find a project risk management plan example online that will help you understand how this process works. Simply put, project risk management is the process of applying the same risk management strategies we have already discussed to a specific project. This will be very different from risk management for an entire organization because the budget of a project is far more limited and projects also have a defined end date.

Risk identification in project management is particularly crucial as unknown risks can completely derail a project. As with organizational risk management, or enterprise risk management as it is also referred to as you will also need to evaluate these risks according to their impact on your project and their likelihood. It is also important to run a cost-benefit analysis where the costs of mitigating each risk are compared against the potential negative financial consequences of the risk occurring on the project.

Risk Management Framework

As you go about setting up your risk management plan, many professionals will recommend that you adopt a risk management framework. The established standard is the framework standardized by the National Institute of Standards and Technology (NIST). A framework is a template with guidelines for how to apply best practices when it comes to risk management. A NIST risk assessment procedure helps you identify where you are at when it comes to aligning your organization with the risk management framework. It’s important in preparing for a NIST assessment to set up a clear plan for following the guidance within the template. You will also need to identify those employees in leadership roles for the project to be successful. Who will be responsible for managing these risks?

There are many sites online that provide NIST risk management framework checklists that you can use to get your risk management plans aligned with the best practices in the industry. You could also opt to work with a vCISO who will come alongside your organization, as a partner, and help you achieve your risk management and cybersecurity goals.

Risk Management Course

Risk management is a complex topic and many professionals may opt to take a risk management course in the subject from a reputable provider. Just taking one risk management course online will not equip you with the knowledge and expertise to build an entire risk management plan, but it could help you to understand the general concepts. If your business is in the financial industry, you might also consider taking a financial risk management course. These courses can be helpful for some professionals. However, for others, they can simply get in the way of getting their work done. If you feel this way, you might want to start working with a partner who will help guide you through the entire risk management process as well as provide you with the tools you need to succeed. That partner is Trava. Book A Demo Today.